Let’s be honest for a hot minute, okay?

Why do you buy insurance – health/motor/life/home – any insurance?

The primary purpose is the same – for financial aid to kick in when the time comes (against the premium you have paid off diligently), that would

- Safeguard your primary savings and

- Shield the future financial interest of your loved ones.

Now, let’s say you bought an insurance policy to the best of your knowledge – you researched well, compared plans, scrutinized the insurer’s claim settlement record, and then chose a solid and affordable policy.

However, now, the question is, “Will my insurance plan have my/my family’s back when I need it?”

So, how can you become certain that your claim will be approved and settled in full (with no partial settlements)? Let’s break it down for you (the horrors, the circumstances, and the preventive steps)!

Insurance Claim Rejections – A Reality Check

Insurance claims rarely collapse because someone’s targeting you: they fall apart when policyholders don’t see the pitfalls waiting, like a missing receipt buried under a stack of damp papers. Claim denials often spring from the policy’s hidden corners, from fine-print exclusions you breezed past when buying, to treatments no one mentioned needed a green light first.

The worst part? That sharp twist in your chest when it finally hits. You don’t notice those blind spots until you’re already scrambling, like spotting smoke only after the fire’s caught. It’s no surprise that so many claims get stuck in limbo, filed, trimmed down, or tossed out before the ink’s even dry.

| Roughly 4.3 million health insurance claims were rejected or partially approved in India during the 2024–25 financial year. |

Claim Rejection Scenarios & Solutions!

Scenario 1: You had the best possible insurance plan in the market, but never shared the details with your family. And now, when you needed insurance, they didn’t know. Your insurance never got a chance to help you out.

THE STORY: Let’s assume that you followed all the right steps to purchase insurance, aka –

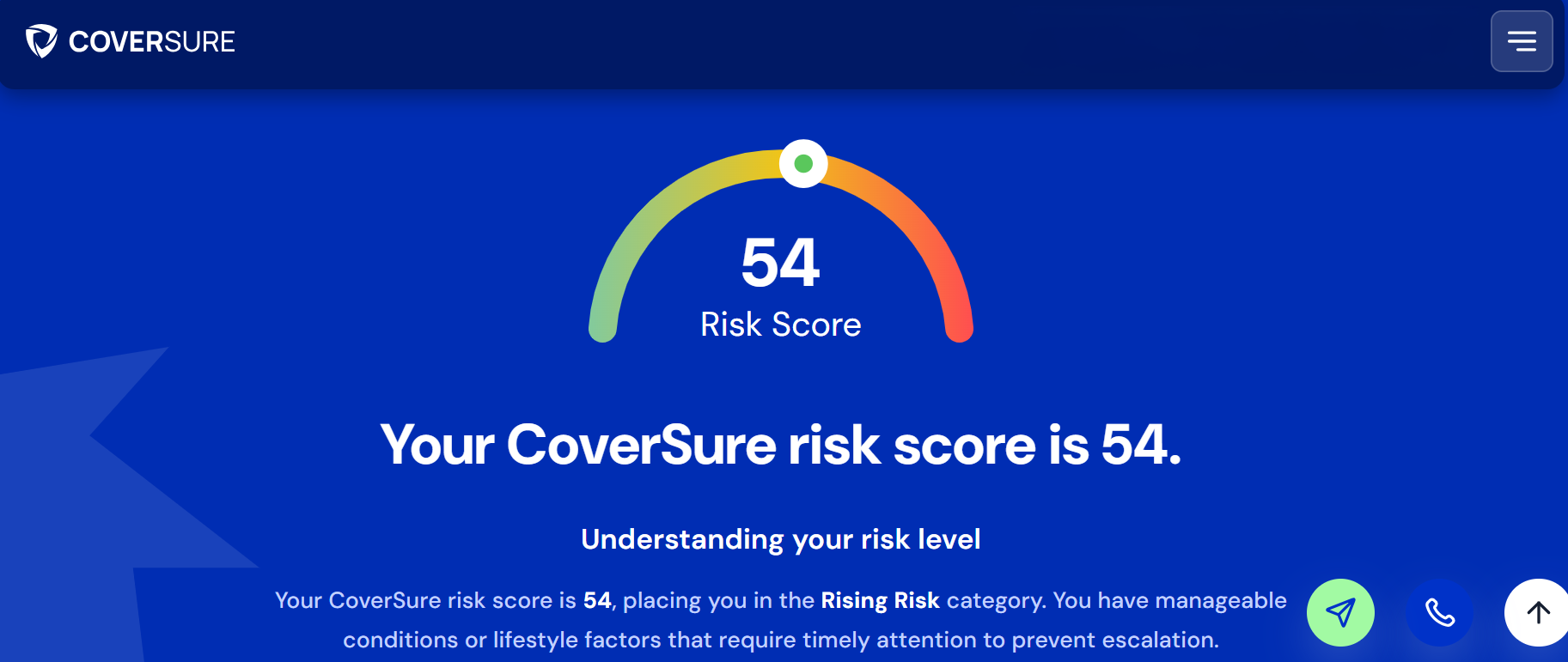

Step 1: Calculate your risk via a free risk calculator to know your ideal coverage.

Step 2: Decided on the customized insurance benefits that you need

Step 3: Sorted the top 5 plans from credible insurers.

Step 4: Compared the plans across 3 fronts – premiums (for affordability), features, and add-ons.

Step 5: Finalized the plan.

However, there is 1 step that you completely forgot about – sharing the policy details with your family. Because God forbid, if you are the one in distress, how do you handle the insurance details and claims? Now that your family doesn’t know about the plan, they end up settling the claims completely out of their pocket, and thus, your savings deplete.

THE SOLUTION: 2 sets of solutions exist in this case –

- CASE 1: If you are stuck in this situation and your family has cleared the claim out of their pocket

There is a window for reimbursement if you are fast enough to file for it. Reach out to your insurer, drop a query about the timeline, and do the needful.

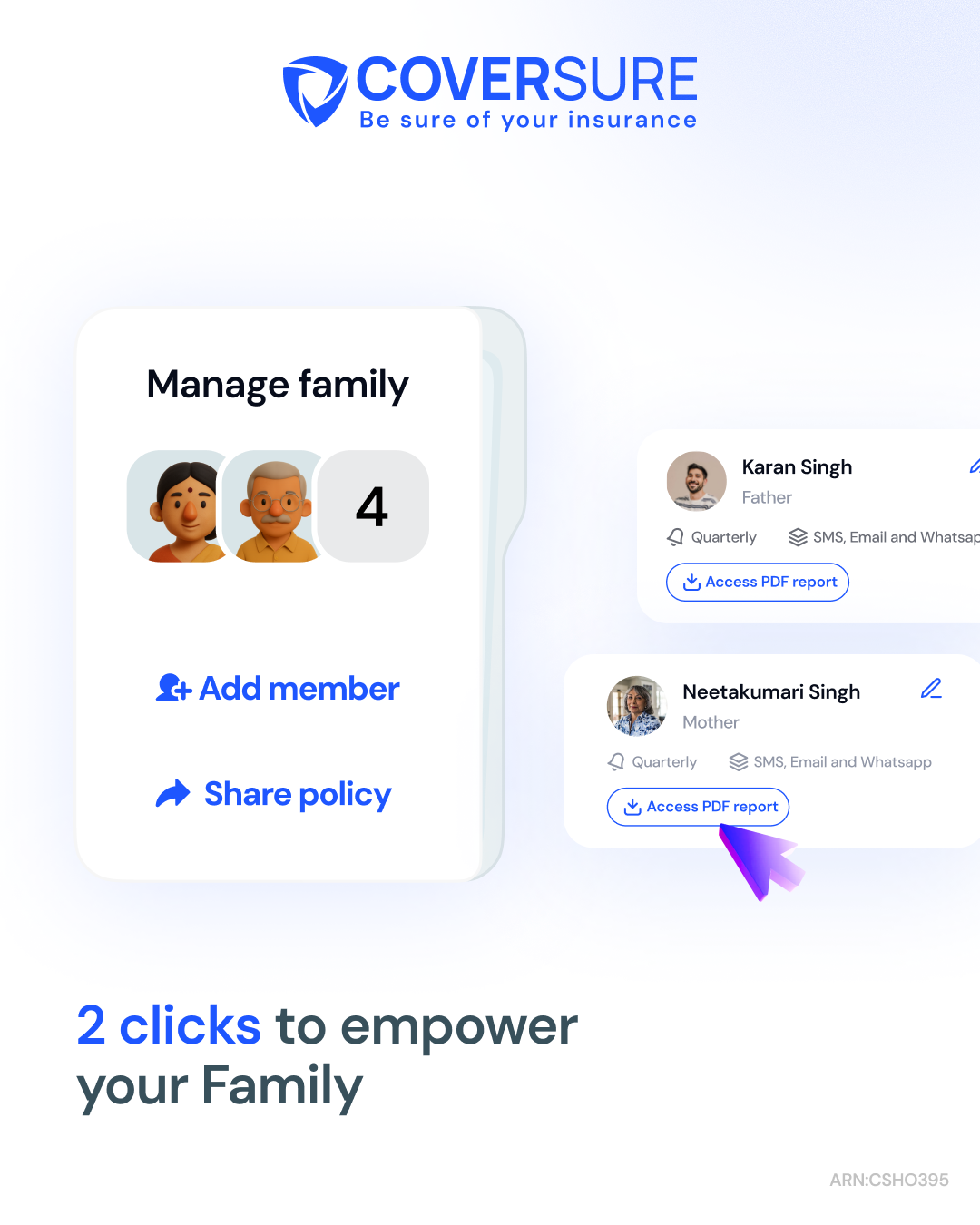

And then, immediately ensure that your family has all the policy details. Our thoughts? A digital option is always a better way out. You can try out the CoverSure app, record all the plans you have, and then opt for the “Family Share” tab to ensure that your family stays updated about the plans you have (with or without the family).

- CASE 2: If you are reading this before any chance of claims pops up

No use crying over split milk. For now, utilize the “hung curd” you gained!

Log in to the CoverSure app now, and take advantage of the “Family Share” option. Make sure your family is aware of the insurance plans you have.

Think of this advice as the lemonade you make out of the lemons that life gave you!

Scenario 2: You forgot to look under the hood of the policy (read: exclusions) and now, your claim has been rejected.

THE STORY: Each plan comes with a set of exclusions, be it health insurance, life insurance, motor insurance, or home insurance. The reasons for the exclusions are largely to shield the financial interest of the insurer. However, in case your condition/surgery/treatment falls under the exclusion list, your insurer will not pay for it, despite there being extensive coverage. So, you end up paying out of your pocket.

THE SOLUTION: Take a look at the policy details (exclusions and sub-limits) during the free look period. Make sure that your opted plan doesn’t exclude what you need! (Subtle hint: A Know Your Policy-like feature might help you decipher those medical + financial + legal jargons!)

Scenario 3: You have optimum coverage, and yet your claim got partially settled. You ended up paying out of your pocket.

THE STORY: You were smart. You analyzed your risk (with a free CoverRisk Calculator), opted for the ideal coverage, chose the best possible add-ons, and selected a credible insurer.

Yet, when you went in for a claim, your insurer settled the claim partially despite an available extensive coverage. So, what went wrong? One phrase – sub-limits!

THE SOLUTION:

- Look closely at your policy’s sub-limits. Make sure to choose a plan with no sub-limits.

- Use the free look period to look through the fine details of the policy.

Scenario 4: You forgot to submit a few documents with the application process or claim filing.

THE STORY: You opted for a solid policy. The premium is affordable, the features are value-adding, and the add-ons are justified. However, when you make a claim, your insurer rejects it. Reason? Missing documents. (Can be documents that you submitted for claims or during the insurance application). An error that costs you in lakhs of lost claims.

THE SOLUTION:

- When submitting your application for an online policy, request the insurer for a list of documents to be submitted. Cross-check each before attaching the soft copies.

- When it comes to claims, request the company in question for all possible documents, and then your insurer or the TPA (Third Party Administrator) for the document list. Cross-check the list of required documents before submission.

Scenario 5: Your insurer’s records had outdated personal details, maybe an old address (current/residential) or an incorrect nominee name

THE STORY: Let’s take an example – you’ve held that life insurance policy for years, tucked away like a file you rarely open. You packed up, switched your number, even told the bank, but somehow forgot to update your policy details. When the bad moment arrived, they couldn’t find your nominee, and the insurer’s letter came back unopened. The claim dragged on for months because the old contact and nominee details didn’t line up with the original records, like a form signed with the wrong address.

THE SOLUTION: Every time you move, switch your phone number, or change banks, jump onto your insurer’s portal or app and update your KYC and nominee details – make that your standing rule. It takes under five minutes, yet it can spare you months of claim headaches, like skipping one quick form now to avoid a stack of paperwork later. Keep a digital copy of your latest policy handy, with all the updates saved safely.

Scenario 6: You missed the renewal date and your insurance lapsed, leaving you uninsured and vulnerable

THE STORY: You’ve spent years faithfully paying the premiums on your car and health insurance, watching those payments leave your account like clockwork each month. This year, with work piling up and flights to catch, you ended up missing the renewal notice by just a week. Just a few days after your policy expired, your car got into an accident, and the insurer turned you down – the coverage had already lapsed. You eventually found out there’s a short grace period for renewal, but it only keeps your coverage intact if you renew during that window, before any claim pops up. Because the crash happened in the grace period but before you renewed, your policy wasn’t technically active, even though the ink on the last payment notice was barely dry. Even worse, all the No Claim Bonus you’d built up vanished, like watching your savings wiped clean in one click.

THE SOLUTION: Don’t count only on sticky notes or calendar scribbles to remember things. Arrange automatic premium payments with your bank or through the insurer’s app. Just tap a few buttons, and you’re done. Turn on SMS and email alerts, and you’ll get reminders 30, 15, and 5 days before your plan expires. If you miss the due date, be sure to renew during the insurer’s grace period (usually 15 to 30 days, depending on your policy) before that window quietly closes. Renewal delays don’t just stall your coverage; they can erase loyalty perks, cut off continuity benefits, and wipe out claim eligibility while that brief grace period ticks away.

Scenario 7: You filed for a claim beyond the window of time/outside the insurer’s location or network coverage

THE STORY: While you were away in another city, a pipe burst back home and left your floors slick with water. You filed your home insurance claim two weeks later, but the agent told you it had to be submitted within 72 hours of the storm. Likewise, most health and auto insurance plans expect you to file a claim right away, sometimes within a set deadline or through an approved network, before the window closes like a ticking clock. You miss that window, the one that caught the afternoon light, and the insurer is within its rights to turn you down.

THE SOLUTION: Read your insurer’s “claims procedure” section carefully. Check deadlines, phone numbers, and what proof you’ll need. Send in your claim right away, even if a few papers are still sitting on your desk. Letting them know right away usually keeps your claim valid while you pull together the paperwork.

In a Nutshell

Insurance plans are supposed to be your financial safety nets, and in reality, they are. The only star-marked conditions that apply in this case are that you have to stay prepared with your finances based on the policy and policy features that you have opted for. That means having liquid cash ready if you are going to a non-network hospital or have a deductible or co-payment in place, or have a room rent restriction in your plan that you have exceeded. A well-researched insurer and a solid policy always ensure that your claims go through when you need them.

So, when you hear stories about claims that have been rejected, don’t panic – take a closer look and you’ll know what they have missed.

Under the situation where the IRDAI is trying to boost India’s insurance penetration, and the government is offering its wholesome support by reducing GST on premiums from 18% to 0%, rejecting valid claims is the last thing that insurance companies would have on their mind.