Rethinking Insurance for Your Travel Plans

THE BLOG AT A GLANCE: Travel’s taking off! From quick weekend escapes to long stretches overseas, travel has quietly turned into a kind of therapy. However, amongst all this, there’s a small gap that people hardly notice or largely overlook – no matter if you’re dashing off for a weekend or settling abroad for months, […]

Winter, AQI, Insurance: The Trio You Should Be Worried About!

Unfortunately for us, “Winter is here.” Instead of savouring warm mornings, lively evenings, or the soft blur of mist over the streets, most of us end up coughing, wheezing, and gasping for air, thanks to the choking AQI (Air Quality Index – It’s a scale that shows how clean or polluted the air is, and […]

Claim CHAOS to Claim READINESS: The Journey You Never Knew You Needed!

Let’s be honest for a hot minute, okay? Why do you buy insurance – health/motor/life/home – any insurance? The primary purpose is the same – for financial aid to kick in when the time comes (against the premium you have paid off diligently), that would Safeguard your primary savings and Shield the future financial interest […]

What are the Steps to Buy Health Insurance in India?

Steps to Buy Health Insurance in India STEP 1: Assess your health risk STEP 2: Calculate the ideal health insurance coverage that you need STEP 3: Make a list of non-negotiables and negotiables in your health policy STEP 4: Evaluate insurer’s history STEP 5: Shortlist 5-7 Health Insurance Plans that meet your requirements ( […]

Risk Assessment in Health Insurance: The What, The Why, and The How?

You know that you need a health insurance plan that kicks in when you need it the most – medical emergencies, right? That’s incredible! But what if we tell you that before you make that purchase, you should be looking at your customized risks first? And no, we are not just talking about your hypertension, […]

What is Health Insurance?

What is Health Insurance? Health insurance is a form of financial protection against various medical bills, including those related to hospitalization, treatments, or surgeries. In simple words, a legal agreement between the insurance provider and you to make sure that the medical affliction does not hit your pocket hard during emergencies. With the cost of […]

Building Your Wealth the Right Way: Acquiring Wealth, Growing Wealth, and Shielding Wealth!

What if we tell you – “India is growing richer?” No, this is not the hook for a stand-up comedy show. This is the raw truth. Consider this – WEALTH SCENARIO IN INDIA IN 2025 WHAT DOES THAT MEAN? 1 India has a projected GDP growth of around 6.8–7.1%, which translates to boosted corporate profits, […]

Financial Independence and India in 2025: Insurance & Beyond!

As the nation awakes to “life and freedom,” Ever thought about where you stand in terms of Financial Independence? Here’s our 2 cents on this!

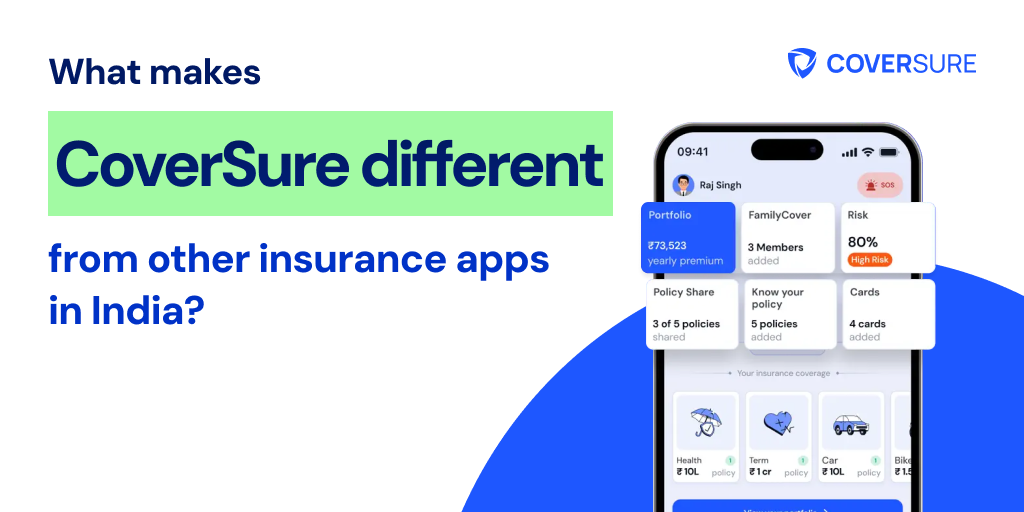

What makes CoverSure different from other insurance apps in India

CoverSure is an insurance management platform that helps you organise, understand, and manage all your insurance in one place, whether it’s a health insurance policy, term insurance, or motor insurance. With CoverSure, you can Key features that set CoverSure apart Most apps focus on only selling their insurance, whereas CoverSure is an insurance engagement platform, […]

What is the “Know Your Policy” feature in CoverSure?

The “Know Your Policy” feature in CoverSure helps users decode and simplify their insurance policies, breaking down complex information into easy to understand sections, so users can fully grasp what their policy covers and where they might be missing protection. Many people struggle to understand their insurance due to push selling tactics, technical jargon, and […]

Chronic Kidney Disease in India: The Growing Risk and Need for Awareness

Chronic Kidney Disease (CKD) is an escalating health concern in India, with studies indicating a high and rising prevalence across urban and rural populations. CKD often progresses silently, earning it the moniker of a “silent killer,” as symptoms become apparent only in advanced stages. This lack of early warning makes CKD a critical public health […]

Keeping your heart happy: Protecting you from Heart Disease in today’s world

Heart disease has become one of the leading causes of death in India, contributing significantly to the country’s health burden. Unlike in the West, Indians are increasingly exposed to heart risk at a younger age, often a decade earlier. This alarming trend is driven by a combination of genetic predisposition, lifestyle changes, and environmental factors, […]