In India, several credit and debit card users unknowingly skip out on insurance benefits they already have, just because no one tells them.

From accidental coverage to health insurance and travel protection, these benefits are often bundled by banks and card networks but rarely activated or claimed.

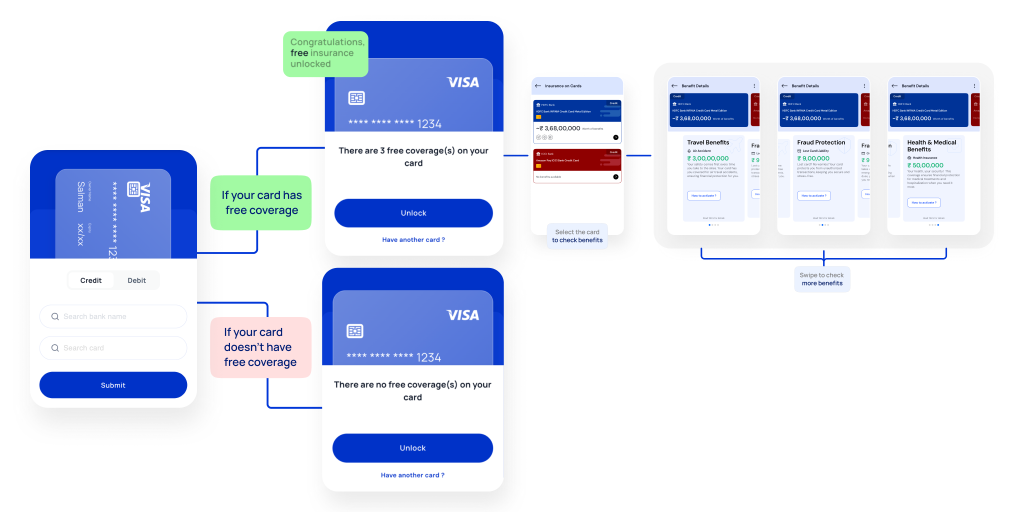

With CoverSure, you no longer need to guess, search across bank websites, or read the fine print. Our app helps you detect hidden covers instantly, right from your phone, with zero hassle. Let’s learn how.

What Is Card-Linked Insurance?

Most people don’t realise that their credit card or debit card may include free insurance protection, like air accident insurance, fraud cover, or even health insurance. These offers come from the bank or card network (like Visa or Amex), but they often go unnoticed and unclaimed.

Why? Because:

- There’s no alert when you become eligible

- Terms are buried in PDFs or welcome kits

- There’s no app that shows them all, until now!

CoverSure’s Insurance on Cards feature solves this, making discovery instant and effortless.

Card-linked insurance is exactly what it sounds like: insurance bundled with your debit or credit card. You don’t need to pay a separate premium because it’s already part of the card’s offering, especially on premium variants or cards used actively.

Common types of card-linked insurance:

- Air accident cover (e.g., ₹3 Cr with HDFC Infinia)

- Lost baggage or trip delay protection

- Fraud or purchase protection

- Health coverage (e.g., ₹50L amex health insurance equivalent)

- Credit card cover and outstanding dues protection (credit shield)

Whether you use a Visa card, Amex, or a bank-issued card, you may already be covered, and CoverSure helps you find out.

Why These Benefits Often Go Unnoticed

Even with premium cards, users miss these benefits because:

- Banks don’t communicate insurance clearly

- There’s no central tracker

- Coverage often depends on card tier (e.g., Platinum vs. Basic)

- Activation may depend on recent usage or ticket bookings

As a result, even users with the right cards don’t know they have a credit card insurance plan, or how to claim it.

How to Use the Feature in the App

To discover your card-linked benefits:

- Open the CoverSure app

- Go to ‘Insurance on Cards’

- Tap “Add Card”

- Select your card issuer and type (Credit/Debit)

- Let the app securely analyse your card

You’ll instantly see a summary of whether any credit card insurance or debit card insurance benefits are available.

What CoverSure’s Insurance on Cards Feature Does

The insurance on cards feature for CoverSure, only works on App.

Simply add your card name and within moments, CoverSure will detect if you’re eligible for any free insurance. It then shows you what you’re covered for, how much coverage is available, and how to activate or claim it.

What You’ll Be Able to See

Once your card is analysed, the CoverSure app will display:

- Type of insurance (e.g., air accident, health insurance, fraud)

- Sum insured (e.g., ₹3 Cr, ₹9L, ₹50L)

- Activation requirements (e.g., ticket booked using card)

- Claim instructions and insurer contact

For example, if you have an HDFC Infinia card, you’ll see a card benefit summary like:

HDFC Bank INFINIA

- ₹3,68,00,000 worth of benefits

- ₹3 Cr Air Accident Cover

- ₹9L Lost Card Liability

- ₹9L Credit Shield

- ₹50L Health Insurance

However, if you have an Amazon Pay ICICI credit card, the app will clearly say: “No benefits available for this card”.

Also read Types Of Insurance On Debit Card or Types Of Insurance On Credit Card.

Things to Watch Out For

Some benefits aren’t auto-activated. Keep in mind:

- Coverage may require recent usage (e.g., flight booking, payment threshold)

- Terms may differ across variants (e.g., Signature vs. Platinum)

- Always check the activation steps shown inside the app

- Claiming might require original transaction proof or ticket copies

The app will guide you through all of this, with buttons like “How to activate?” shown under each benefit.

Also read Debit Card Insurance in India: What’s Really Covered

CoverSure for Insurance on Cards

With CoverSure, you might discover that you’re already protected, without ever buying a separate policy. From visa insurance to Amex health insurance and bundled credit card cover, your cards may be silently guarding you, and now you’ll actually know.

If you’re someone who’s been searching for the best credit card for insurance payments, don’t forget to also check what’s already in your wallet. One quick scan in the CoverSure app could unlock lakhs worth of protection.

Download the CoverSure app, head to “Insurance on Cards”, and explore your hidden benefits today.