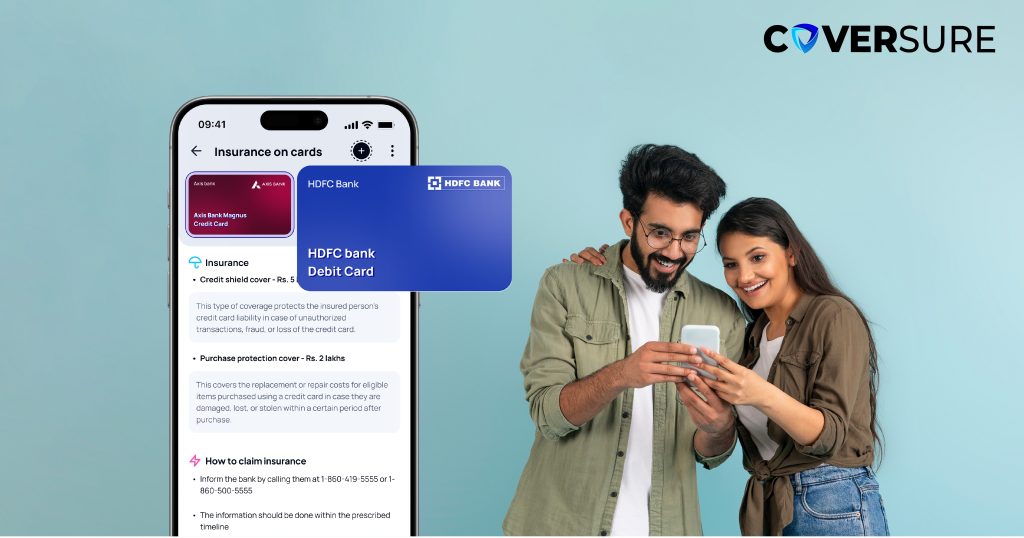

Debit cards have become a staple in our daily lives, making it easier and faster to manage our money. Whether you’re shopping online or tapping to pay at the grocery store, debit cards offer unmatched convenience. But with this convenience also comes the risk of loss, theft, or misuse. That’s where debit card insurance steps in. In this blog, we’ll explore how it can protect you from these risks and the different types available in India.

First, What Is Debit Card Insurance?

Debit card insurance is a valuable safety net that can save you from financial headaches due to unauthorized use, loss, or damage to your card. Here’s what it covers –

- ATM Fraud:

If your card gets stolen or skimmed at an ATM and unauthorised withdrawals are made, this insurance will reimburse you for the lost funds, so you’re not left out of pocket.

- Card Loss:

If you misplace your debit card and it gets used for unauthorised transactions before you report it lost, the insurance can cover those unauthorised charges up to a certain limit, giving you peace of mind.

- Accidental Damage:

Some policies even cover accidental damage to your card, such as if it gets physically broken, saving you the cost of getting a new one.

- Unauthorised Transactions:

In case someone uses your debit card details without your permission to make purchases, whether online or in-store, this insurance can reimburse you for those unauthorised charges, within the limits of your policy.

With such a policy, you’re protected against these common risks, ensuring you can handle unexpected situations without financial stress.

Types Of Debit Card Insurance In India

In India, debit card insurance usually falls into two categories:

- Complimentary Insurance:

Some banks offer free insurance with certain debit cards. The coverage details can vary a lot, so it’s best to check with your bank to see what’s included and what isn’t.

- Optional Add-On Cover:

Many banks also offer additional debit card insurance that you can purchase. These policies generally provide more comprehensive coverage compared to the complimentary ones, but they may come with higher premiums. This way, you can choose a plan that fits your needs and gives you extra peace of mind.

Benefits Of Debit Card Insurance:

Here are some key reasons why it is a game-changer –

- Quick And Easy Claims:

If something goes wrong, dealing with insurance is a breeze. You can get your money back quickly and easily, without any major hassles.

- Ensures Peace of Mind:

With insurance, you can use your debit card without constantly worrying about fraud. It’s like having a safety net that lets you relax and focus on what really matters.

- Enhanced Security:

Knowing you have insurance can deter fraudsters. It’s like having an invisible shield that makes them think twice before targeting you.

- Financial Safety Net:

If someone does manage to tamper with your card, insurance has your back, covering any losses and keeping your finances safe.

Things To Consider With Debit Card Insurance

Here are a few key things to keep in mind before you opt for for it –

- Understanding Your Coverage:

Make sure to review the policy details to see exactly what’s covered and be aware of any exclusions or limitations. This way, you’ll know the protection you have and what is excluded.

- Eligibility Requirements:

Some banks automatically offer debit card insurance with certain types of cards, while others might require you to opt in. Check your bank’s requirements to ensure you’re eligible.

- Knowing Your Deductible:

The deductible is the amount you need to pay out of pocket before the insurance covers the rest. Knowing this amount in advance helps avoid surprises if you ever need to make a claim.

- Cost of Insurance:

The price of this policy can vary depending on the coverage and the bank offering it. Compare different options to find one that fits your budget and needs.

Wrapping Up!

Debit card insurance is a key part of protecting yourself against unexpected issues with your card. By learning about the types of coverage available, their benefits, etc., you can make smart choices that give you confidence and peace of mind.

We hope this guide has helped you understand debit card insurance better. If you have any questions or need personalised advice, don’t hesitate to reach out to our experts at CoverSure. We’re here to help you find the best insurance solutions to keep your finances safe and sound.