| Steps to Buy Health Insurance in India

STEP 1: Assess your health risk STEP 2: Calculate the ideal health insurance coverage that you need STEP 3: Make a list of non-negotiables and negotiables in your health policy STEP 4: Evaluate insurer’s history STEP 5: Shortlist 5-7 Health Insurance Plans that meet your requirements ( cover your risks and meet your requirements) STEP 6: Get a quote for all plans and make a choice based on your long-term affordability STEP 7: Repeat the steps before every renewal/port/new policy purchase OPTIONAL STEP: If all this sounds too overwhelming, talk to a CoverSure Health Insurance Advisor |

Whether you are 18 or 80, you need a health insurance plan – because health risks never look at the number of birthdays you have celebrated before knocking at your door.

But you are smart – you already know that.

The current, recurrent question is – “How do I buy health insurance?”, and the doubt is well-justified –

- REASON 1: Now that the demand for health insurance plans has increased, there are more plans in the market (as compared to a decade ago).

The result: Confusion among potential policyholders.

- REASON 2: Health insurers often roll out polished campaigns that put their plans front and center.

The result: That might make it hard to pick the plan that truly suits you.

- REASON 3: Some health insurance platforms push the plans from their own partners.

The result: You could end up picking a plan that costs more or doesn’t quite match the coverage you need.

And hence,

| CoverSure says: “Understanding the right way to buy health insurance plans is one of the most important financial decisions you take for the long term. Once you know this, buying a solid, affordable, and customized health insurance policy becomes a cakewalk.” |

In case you are stuck in a similar situation and are wondering which health plan to choose, how much coverage you really need, or how to balance cost with benefits, this blog is for you. Let’s help you!

What are the Steps to Buy Health Insurance in India?

STEP 1: Assess your health risk

As soon as you plan to buy a health insurance policy, your first thought should be, “What’s my current health risk?”

When we say, health insurance isn’t a one-size-fits-all financial product, we indicate this – health risks vary for each individual. And we are not just talking about your current health conditions, we are talking about –

- Your genetic predisposition towards ailments.

- The quality of the air in the city you reside in, etc.

- Probable lifestyle ailments (based on your current work profile, exercise habits, smoking, drinking, etc.)

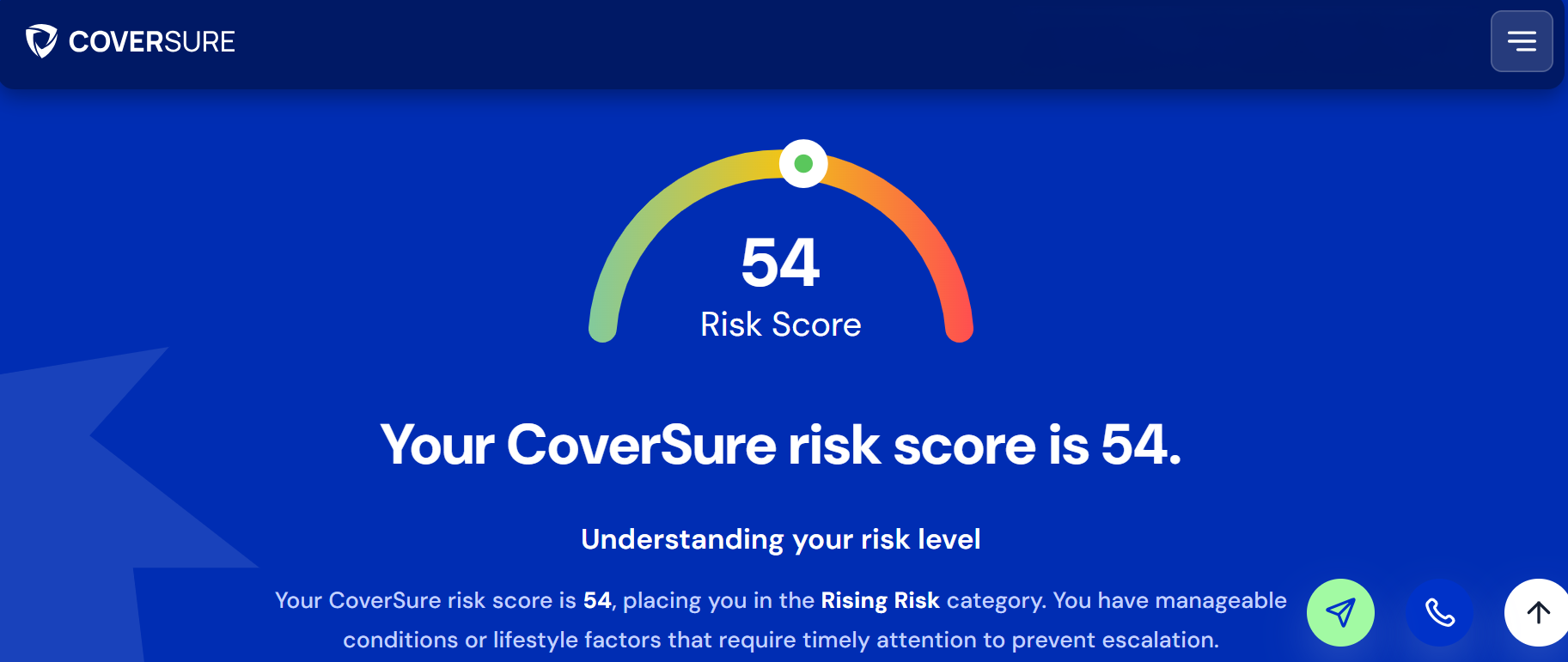

| This is an illustrative comparison of two individuals with varying health conditions to show you how the health risk score differs from one case to another. This shows how your coverage changes over time, and hence the importance of analyzing health risks every year before policy renewal/porting/migration. | ||

| USE CASE | Case 1: Atul (25+) | Case 2: Aditya (62+) |

| Conditions |

|

|

| Risk Score (estimated) | 54 (Rising Risk) | 66 (High risk) |

| Interpretation | While there are no serious concerns now, there’s a chance of acquiring ailments later. And in a Tier 1 city, those conditions might require Atul to opt for a low coverage, but comprehensive plan (whose coverage can be boosted later). | The health risks are pretty high, leaving greater chances of hospitalization over current and imminent ailments.

Thus, despite being in a Tier 2 city, Aditya should be looking at a wide coverage (which can tend to be a bit expensive, but can be cut down with a few smart choices that we will discuss later on). |

As you can see from the illustrative example, health risk differences can make all the difference in choosing a health insurance plan. Thus, analyzing/calculating your health risk is the Ground Zero from which your health insurance purchase journey should start.

We would recommend you opt for a free, scientific, AI-equipped, dynamic, and flexible tool like CoverSure’s Risk Calculator that can offer you an unbiased Risk Score.

| CARRY FORWARD FROM STEP 1: A Health Risk Score that reflects your current health issues and probable conditions. The score will play a crucial role in deciding your ideal health insurance coverage. |

STEP 2: Calculate the ideal health insurance coverage that you need

Once you’ve figured out your CoverRisk Score and level, you can choose how much coverage you need. This is the single most important question in your buying journey, because the right coverage hinges entirely on your health and the state of your finances, think medical history and what’s in your bank account.

So, what are the basic factors that a scientific and unbiased tool like CoverRisk looks at? Here are a few important pointers –

- The Inflation POV: The calculator factors in medical inflation (year-on-year) to ensure that your coverage is capable of handling serious ailments requiring an extensive hospital stay today and the rising costs of similar medical services tomorrow.

- The Number of Dependent POV: It factors in your family size, since every new mouth at the table means your coverage has to stretch further.

- The Location POV: It accounts for where you reside, because in metros like Delhi or Mumbai, compared to the rest of the states/cities, healthcare costs spike a lot faster (by about 10-15%).

- Miscellaneous Costs: It includes the hidden extras that can range from diagnostic tests to OPD visitations for follow-ups, since no treatment ends at discharge.

- Financial Limitations/Bandwidth Available: It also weighs on your budget, because what seems financially feasible today might not be the same tomorrow. A premium that can be realistically sustained without compromising your monthly expenses and future life landscape (spouse, dependent children, varying long-term financial goals, and ageing parents).

| This is an illustrative comparison of two individuals with varying health conditions to show you how the health risk score differs from one case to another. This shows how your coverage changes over time, and hence the importance of analyzing health risks every year before policy renewal/porting/migration. | ||

| USE CASE | Case 1: Atul (25+) | Case 2: Aditya (62+) |

| Conditions |

|

|

| Risk Score (estimated) | 54 (Rising Risk) | 66 (High risk) |

| What’s the approximate ideal coverage? | Approx. ₹5 – 10 lakhs

While the individual resides in a Tier 1 city, since he has no major ailments now, but might acquire them later, he can take up this coverage and later boost as dependents are added, and he goes through other life stage occurrences. |

Approx. ₹15 – 25 lakhs

The individual is a senior citizen with a list of PEDs and a high risk of acquiring more that might lead to frequent hospitalization. Hence, the extensive coverage. Now, this cover may get expensive, but there are a few options to lighten the financial burden (disclosed below). |

| CARRY FORWARD FROM STEP 2: Now, you know about your ideal health insurance coverage via a scientific method and considerations. This opens up all the right avenues for you, and now, you can start looking into the details of your health insurance policy features. |

STEP 3: Make a list of non-negotiables and negotiables in your health policy

Picking the right coverage amount is only half the work. The other half is picking the features that really count.

Now, we have crafted a list of negotiable and non-negotiable features when you are about to purchase a health insurance policy. However, please note that whether these features are a mandated requirement for you or not largely depends on your health and financial bandwidth (since the following features have a considerable impact on the claim situation in health insurance plans).

- Co-payment: Co-payment means you cover part of each claim (say 20%), while the insurer picks up the rest, like settling the balance after you’ve paid at the counter.

| CoverSure Tip: If your plan includes a co-pay, find out exactly how much you’ll owe, even if it’s just a few dollars for a routine check-up. Honestly speaking, co-pay only makes sense if you’re a senior citizen (with extremely high health insurance premiums) or an individual with a critical PED (having a difficult time landing a solid health insurance policy). |

- Room-rent restrictions / room-rent sub-limits: Many policies set a daily limit on room rent, either a fixed amount or a percentage of the sum insured, like ₹3,000 a night in a modest city hospital. Go over the limit, and your insurer can cut your claim, trimming not just the excess room rent but a pro-rata based share of the total hospital bill.

| CoverSure Tip: If you’re planning on booking a private or AC room, pretty common in big-city hospitals, go for a plan that skips the room-rent cap or keeps limits to a bare minimum. Don’t let the hospital catch you off guard; know what’s coming, from the beeping monitors to the paperwork pile. |

- Disease-wise sub-limits: Some policies cap how much they’ll pay for specific illnesses or treatments, like maternity care, heart procedures, or regular dialysis sessions.

| CoverSure Tip: If you or a loved one might need certain treatments, say for a heart condition or a bone injury, check that the plan doesn’t hide sneaky limits. |

- Pre-hospitalization and Post-hospitalization coverage: A solid plan pays for what happens before you’re admitted, like blood tests or scans, and after you leave, from prescriptions to follow‑up visits.

| CoverSure Tip: Aim for at least 60 days before and 90 to 120 days after coverage (many plans go further), so you don’t get stuck with a big hospital bill right after your stay. |

- Second medical opinion/OPD coverage/maternity/international cover: These add‑ons can make a big difference, depending on where you are in life and what you need.

- whether it’s extra coverage for a new baby or

- support during OPD visitations over minor consultations.

- Or you’re hoping to start a family within the next year or two, maternity coverage can be a big deal; it’s the safety net you’ll be glad to have when hospital nights get long.

- Or you’re moving or spending time abroad, international cover could be worth considering, especially if you’ll be walking foreign streets or visiting unfamiliar clinics.

| CoverSure Tip: Don’t grab every add‑on just because it sounds appealing; pick the ones that truly fit your life right now and won’t drain your budget. |

- Deductibles and unlimited restoration: The deductible, what you pay out of pocket first (before your insurance policy kicks in), and the restoration benefit, which refills your coverage if it runs out in the same policy year, both matter.

| CoverSure Tip: Restoration can be a real help, especially if you’re at higher risk and might file more than one claim in a year. If your plan skips restoration, your health insurance policy can turn dormant (during hospitalization claims) after a single claim. |

| This is an illustrative comparison of two individuals with varying health conditions to show you how the health risk score differs from one case to another. This shows how your coverage changes over time, and hence the importance of analyzing health risks every year before policy renewal/porting/migration. | ||

| USE CASE | Case 1: Atul (25+) | Case 2: Aditya (62+) |

| Conditions |

|

|

| Risk Score (estimated) | 54 (Rising Risk) | 66 (High risk) |

| Features (negotiable/non-negotiable) to opt for – (exceptions may be considered) |

|

|

| CARRY FORWARD FROM STEP 3: Now, you are aware of your specific risk score, the ideal health insurance coverage, and the features (negotiable and non-negotiable) that you should have in your policy. Time to start scouring for your health insurance policy, starting with the credibility of your health insurance provider. |

STEP 4: Evaluate insurer’s history

Even the most carefully built health insurance plan can let you down if the company drags its feet on claims, leaving you waiting by the mailbox for answers. In the end, the true measure of reliability is how firmly your insurer stands beside you when trouble hits.

When you’re comparing health insurance plans in India, pay close attention to four claim-related metrics.

- Claim Settlement Ratio (CSR): When the CSR tops 90%, you’re likely looking at a claim process that moves quickly and feels reliable.

| CoverSure Tip: Look for insurers that keep a strong CSR record for at least three years, not just a single good year. |

- Incurred Claim Ratio (ICR): The ICR compares what an insurer pays out in claims to what it takes in from premiums. Aim for a sweet spot between 50% and 80%. An ICR under 50% could mean the insurer turns down a lot of claims or charges premiums steep enough to sting. If the ICR tops 80%, the insurer could be paying out more than it brings in, which won’t hold up over time..

- Complaint Volume: How many complaints customers file, especially over claims, delays, or denials, speaks volumes about the insurer’s service quality, like a stack of unanswered letters on a desk. The IRDAI posts annual complaint statistics; you can look them up anytime, down to the last recorded number.

- Number and Proximity of Network Hospitals: A wide, well-connected network of cashless hospitals means you can walk in, get the care you need, and leave without having to pull out your wallet first (read: Cashless Services).

| CoverSure Tip: Make sure the best nearby hospital, where you’d rush in an emergency, maybe the one with the bright red ER sign, is covered under your insurer’s cashless network. A high CSR doesn’t help much if your go-to hospital isn’t one of the partner hospitals of your health insurance provider. |

Put simply, when you’re weighing health insurance plans in India, don’t stop at the “₹X lakhs cover” headline; dig into the fine print, from hospital network size to claim limits, before you decide. The smartest plan fits your risk comfort, budget, and the way you live, like choosing coverage that matches your daily routine, not just the flashiest sum they advertise.

| A Quick Recap: You have taken up all of the important pointers – Health Risk Score, Ideal Health Insurance Coverage, features (negotiable and non-negotiable) to have in your plan, and the metrics to measure your insurer’s credibility. Now, let’s get to the point – the top few health insurance plans (of which you can choose one that best caters to your requirements, as observed through Steps 1 to 4). |

STEP 5: Shortlist 5-7 Health Insurance Plans that meet your requirements (cover your risks and meet your requirements)

Now that you’ve covered the groundwork in Steps 1 through 5, narrow it down to about five plans that fit your risk comfort, budget, must-have perks, and a provider you trust.

Here’s what to do:

When you’ve narrowed it to three to five strong contenders, you’re ready to choose.

Here’s a quick list of the current top plans across the health insurance sector –

| TOP HEALTH INSURANCE PLANS IN INDIA IN 2025 | ||||

| TOP HEALTH INSURANCE COMPANIES | TOP HEALTH INSURANCE PLANS | CREDIBILITY METRICS OF THE INSURER | PROMINENT FEATURES | PROBABLE DRAWBACKS |

| HDFC Ergo | HDFC Optima Secure |

|

|

|

| Care Health | Care Supreme |

|

|

|

| Niva Bupa | Niva Bupa Aspire |

|

|

|

| Aditya Birla | Aditya Birla Activ One Max |

|

|

|

| ICICI | ICICI Elevate |

|

|

|

STEP 6: Get a quote for all plans and make a choice based on your long-term affordability

The first part is simple – just get the quotes for all the plans you have shortlisted and do a quick comparison. This takes care of the short-term financial affordability part.

Now, coming to the topic of “long-term affordability,” here are a few smart tips for you.

Your goal: get the coverage you need without draining your wallet.

- Individual vs Family Floater: Going solo? Opt for an individual health insurance plan. Got a spouse or kids at home that you want to cover? A family floater can shave down your costs significantly.

- Base Policy + Super Top-Up: Combine a solid mid-range plan with a super top-up for those hefty claims, like stacking sturdy bricks instead of gambling on one oversized block.

- Deductibles / Co-pay: A higher deductible can cut your premiums, but it means you will need to be prepared with liquid cash in order to pay a portion (fixed amount = deductible) upfront. On the other hand, a co-payment means lowering your premium significantly, but it also means that you will be paying for a share (a fixed percentage) of the total billed amount out of your pocket each time you are hospitalized.

- Premium Budgeting & Long-Term View: Pick a premium you can stick with every year. It’s not much help if you grab something today and can’t renew it later due to financial constraints.

- Match with your CoverRisk & Location: Match coverage, risk, and location: for example, a big city means more protection and a smaller deductible. On the other hand, in a smaller city, you’ll need to factor in local living expenses and the health risks you might face.

| USE CASE | Case 1: Atul (25+) | Case 2: Aditya (62+) |

| Conditions |

|

|

| Risk Score (estimated) | 54 (Rising Risk) | 66 (High risk) |

| Long-Term Affordability Tips |

|

|

STEP 7: Repeat the steps before every renewal/port/new policy purchase

Buying health insurance isn’t something you just tick off a list and walk away from. Your life shifts, your health follows suit, and the insurance options – along with what you’ll pay for your contemporary healthcare – change right alongside.

Before each renewal, whether you’re switching insurers, sticking to the same plan/insurer, or buying a new policy, go back through Steps 1 – 6, then –

- Run a fresh CoverRisk assessment. Has anything about your health risks shifted (like new symptoms or changes your doctor mentioned)? Has anything shifted in what you can afford (maybe your budget feels tighter or looser than before)?

- Take another look at how much coverage you need right now (maybe you’ve spent a week in the hospital, moved to a new city with a poor AQI, tied the knot, or switched careers).

- See if your current plan still fits your budget and covers what you need (maybe it’s time for something more flexible, like a super top-up, or a plan with more consolidated and cutting-edge features that feel worth it).

- Take a look at the plan’s features (have any new products popped up with perks worth noticing, like a higher cap on maternity, a new add-on option, or an affordable upgrade)? Has your insurer’s track record on claims shifted at all (maybe faster payouts or fewer disputes)?

- Take another look, then choose whether to renew, upgrade, switch, or port.

This habit keeps you covered, so you’re never stuck with a plan that no longer fits you.

OPTIONAL STEP: If all this sounds too overwhelming, talk to a CoverSure Health Insurance Advisor

If the process still feels overwhelming (and let’s face it, with so many moving parts, it’s fine to admit it), you don’t have to tackle it on your own. A CoverSure Health Insurance Advisor can

- Walk you through your CoverRisk Score results and guide you toward the right coverage amount.

- Compare your budget with the coverage you need, then decide on a structure (like a base policy plus a super top-up) for a plan that fits.

- Break down the fine print on perks (features like co-pay, room-rent limits, restoration benefit, and more), so it’s clear and easy to follow, like reading a sticky note stuck to the fridge.

- Help you compare insurers, choose the best plan from your shortlist, and handle the paperwork and claims when they come up, right down to the last signature.

Conclusion

In a country like India, where hospital bills climb fast and a sudden fever can throw your budget off balance, making the right choice really matters. You’re not just picking up a “policy.” You’re securing protection, peace of mind, and the kind of financial safety that lets you sleep through a storm.

Think of this blog as your go-to checklist to understand the steps to buy health insurance. Go ahead and run the CoverRisk assessment—pull up the file and start checking each section. Check the features, skim every line of the fine print, and make sure the insurer you pick will stand by you when it counts.