| What is Health Insurance?

Health insurance is a form of financial protection against various medical bills, including those related to hospitalization, treatments, or surgeries. In simple words, a legal agreement between the insurance provider and you to make sure that the medical affliction does not hit your pocket hard during emergencies. With the cost of healthcare increasing, having health insurance plans is all the more important. Early purchase implies more coverage and peace of mind, and lower premiums! You would not want to have all your savings liquidated when most needed. |

Introduction

Whether you are 8 or 80, health risks can come knocking on your door without a heads up – that’s an undeniable truth. And say you come face-to-face with a health crisis, what are the implications?

- You get hospitalized/undergo long-term treatment

- Your source of income gets compromised

- Your savings dip

-a legitimate crisis across finances and family fronts. And considering the spiked bills in the hospitals (on account of the shooting medical expenses), one critical ailment can wipe out your savings in a matter of days. Hence, you simply can’t afford to turn down funding that promises to have your back when you face medical emergencies – that’s what health insurance is about. But, here’s the twist – that’s NOT ALL – health insurance plans can be much more than mere claims during hospitalization.

Ready to know? Read on!

| TOP HEALTH INSURANCE PLANS IN INDIA IN 2025 | ||||

| TOP HEALTH INSURANCE COMPANIES | TOP HEALTH INSURANCE PLANS | CREDIBILITY METRICS OF THE INSURER | PROMINENT FEATURES | PROBABLE DRAWBACKS |

| HDFC Ergo | HDFC Optima Secure |

|

|

|

| Care Health | Care Supreme |

|

|

|

| Niva Bupa | Niva Bupa Aspire |

|

|

|

| Aditya Birla | Aditya Birla Activ one Max |

|

|

|

| ICICI | ICICI Elevate |

|

|

|

(Please Note: Having a great network of 10,000+ hospitals is one thing, but the proximity matters. In case the partner hospitals don’t lie around your location, this otherwise “key benefit” of having health insurance plans proves to be of no use during emergencies.)

What is Health Insurance in India in 2025?

Technically, health insurance is a legal financial contract between the insured and the insurer that offers funding to the policyholder during times of medical emergencies (hospitalization, extensive treatments, etc.).

In layman’s terms, health insurance is a pre-decided funding/coverage that kicks in when you need it the most – medical emergencies.

With the healthcare costs shooting up, the real question should not be “Do I need health insurance?” – but rather “Why don’t I have one yet?” A simple visit to the hospital may prove expensive; lifestyle issues like asthma, diabetes, and high blood pressure are affecting Indians at a younger age.

Solid health insurance in India ensures you’re prepared financially for when those “surprises” from a medical perspective hit. It’s not just all about rare emergencies; it’s more geared towards preparedness for everyday modern life.

Today, an insurance plan is not an afterthought but a planning feature and a prudent investment. The sooner you buy, the better the cover, the lower the premium, and the higher your peace of mind.

Now, it’s all about

- What kind of health insurance do I need?

- What is my ideal health insurance cover amount?

- What health risks should my health insurance policy cover me for?

- What are the top health insurance plans for me?

- How do I buy a health insurance plan?

- What’s the best way to cover my parents?

In the sections to follow, we will address these questions and ensure that you neither go uninsured nor overinsured.

What are the Different Types of Health Insurance Plans in India in 2025?

As the demand for health insurance plans spiked, insurers started crafting policies that catered to the customization requirements of potential and existing policyholders. Thus, a variety of health insurance plans popped up that were largely based on the number of policyholders covered, the age of the insured individuals, ailments covered, and more. Here’s a quick look at the different types of health insurance plans that are being availed by current client pools –

| TYPES OF HEALTH INSURANCE PLANS | IMPORTANT POINTERS | COVERSURE’S

RECOMMENDATION |

| Individual Health Insurance |

|

✅

(A must-have for everyone) |

| Family Floater Health Insurance |

|

✅

(An affordable solution for a family.) |

| Group Health Insurance |

|

✅

(A good perk to have.

Must be accompanied by an individual or family floater plan.) |

| Senior citizen health insurance |

|

✅

(A must-have for those in their golden years to avoid dipping into their retirement funds). |

| Critical Illness Health Insurance |

|

✅

(The best financially futuristic step you can take, considering the increasing risk of critical illnesses across the country.) |

| Super Top-Up Health Insurance |

|

✅

(An incredible solution to get massive coverage at pocket-friendly premiums.) |

| Personal Accident Insurance |

|

✔

(A good financial cushion for frequent travelers and ones with risky occupations.) |

| Disease-Specific Health Insurance |

|

✔

(Can be a good plan for those with a predisposition towards certain ailments or PEDs.) |

| Maternity Health Insurance |

|

✅

(A solid plan to have if you have planned well in advance to cover the waiting period.) |

| Government-Specific Health Insurance |

|

✔

(Good perk to have as a fall-back, considering the premiums.) |

Why Should You Avail Health Insurance Policies in India in 2025?

Post-COVID-19, fewer questions were thrown around about “Do I need health insurance?” and more were about “How to Purchase Health Insurance?”

However, 1 problem still remains – people are vastly unaware of why health insurance is such a necessity. And unlike popular belief, health insurance plans are not just about claims; multiple benefits exist that ensure that you have earned your penny’s (read: premium’s) worth!

Here’s a quick look at some of the benefits offered by the top health insurance plans –

- Standard Benefits: In short, benefits that people know about and are commonly available across all health insurance plans.

- Rising cost of medical services – The rising cost of medical care is hard to ignore. Walk into a hospital today, and even a routine check can leave you staring at a hefty bill. A quick surgery or just a couple of nights in the hospital can drain your savings fast, like watching bills stack up on the bedside table. Health insurance keeps you a step ahead by covering most of your treatment costs, so an unexpected hospital bill doesn’t blindside you.

- Financial Cushion During Emergencies – Medical crises don’t give you a warning; they hit like a slammed door in the night. Whether you’re hit by a sudden illness or caught in an accident, insurance works like a steady hand, covering the bills so you can focus on healing, instead of worrying about your bank account.

- Safeguarding your savings – You’ve worked hard to build your savings, so why let a single hospital bill sweep them away like sand in the tide? With health insurance in place, you won’t have to dip into your emergency fund. The insurance covers the costs, so your savings stay tucked safely in your account.

- Access to enhanced medical care – With insurance, you can step into cleaner, better-equipped clinics, see top specialists, and choose treatments that might’ve felt financially out of reach before. It lets you choose quality care with confidence, so you’re not pausing to count every rupee.

- Cashless Hospitalization at Network Hospitals (+ reimbursement) – Most insurers partner with certain hospitals, letting you walk in for treatment without paying a rupee upfront. Just flash your health card, and the insurer takes care of the bill right there at the hospital desk. Even if you end up in a hospital outside the network, you can still be reimbursed for what you’ve paid- like the bill for that overnight stay.

- Covers Daycare Procedures and Surgeries – Daycare procedures and surgeries are now covered, so you no longer have to spend a full day in the hospital just to file an insurance claim.

- Maternity & Newborn Coverage (in select plans) – Maternity and newborn coverage are included in certain plans (either as an in-built perk or as an add-on feature). These days, plenty of health insurance plans cover maternity costs, from the prenatal care of the mother to the first-year vaccinations of the newborn- though the fine print still applies. Remember, there’s often a waiting period involved, which can range from 9 months to 4 years based on the plan you choose.

- Domiciliary and AYUSH coverage – Stuck at home and can’t reach a hospital (or maybe no beds are available, like what happened during COVID)? You can still get treatment right in your own living room. The insurer covers all your treatment charges. This is one of the most common/standard perks available with all top plans.

If you’re drawn to Ayurveda, Yoga, Unani, Siddha, or Homeopathy, pick policies that cover those options too, so you can choose the path that feels right.

- Tax Benefits Under Section 80D – Under Section 80D of the Income Tax Act, the health insurance premiums you pay could help you claim tax deductions.

2. Hidden Benefits

- Covers Pre- and Post-Hospitalization Expenses – Not all of your expenses begin on the day of admission. Many a time, it starts with visits to doctors, tests, and medicines before being hospitalized, and continues even after discharge. Much to your relief, a lot of policies cover this as well. You get reimbursement for X-rays, scanning follow-ups, and the like.

- Annual Health Check-ups – Because why wait to fall ill and then visit a doctor? Most of the health plans generally include one annual free checkup. Therefore, every year, this is done at no extra cost to ensure you stay on top of things; it’s called paying for a good reason. Isn’t it better…cheaper to prevent than cure?

- Mental Health & OPD Coverage (in select plans) – Your mental health is an important aspect of your overall well-being, just as your physical health. Some of the plans these days do entertain the coverage of mental health treatments and therapy sessions along with OPD expenses like clinic visitations, minor procedures, prescribed medications, etc.

- Protection from Inflation in Healthcare – The inflationary trend of medical costs each year ensures that your sum insured increases annually, provided you have the right health plan. Almost all the insurers offer “inflation protection” or increase the cover amount annually, in case no claim has been made by the insured in that policy year.

- No-Claim Bonus and Other Loyalty Benefits – Haven’t claimed in this year? You are rewarded with no additional premium paying by letting your sum assured grow with No-Claim Bonuses. Some plans also add on loyalty benefits over time – discounts or extra cover.

- HospiCash Perks – Even though your bill is covered, some plans provide cash every day while you are in the hospital. Spend it on anything- food, travel, or income you missed out on. It’s a little financial cushion for those additional hidden costs.

- Funding Second opinions – Not certain about a diagnosis or proposed surgery? Some policies pay for going to another specialist for a second medical opinion, since it is always okay to double-check when your health is on the line.

- Teleconsultation coverage – Too busy to go to a clinic? You can talk to a doctor right from your phone or laptop. Most health plans include free teleconsultations, making access to expert medical advice a cakewalk.

- Consumable coverage (in select plans) – These include gloves, masks, and syringes that can add up to about 5% of the total bill. At least, some policies now cover these ‘’consumable items,’’ which may otherwise add up to a big chunk of your hospital bill.

- Multi-pay premium discounts – Another way to save with most insurers is by paying the premiums for 2 or 3 years. Considering your financial commitment, your insurer often offers a “bulk discount” on your premiums!

What Is Your Ideal Health Insurance Coverage in India in 2025?

Health insurance is definitely not a one-size-fits-all situation. What works for someone else could be a poor fit for you. Before you choose a policy, let’s stick to the essentials and keep it straightforward.

- Your age – Your age is a big factor. Honestly, the younger you are, the less you’ll pay in premiums. If you sign up early, you also avoid extra waiting periods or annoying exclusions that can show up later. It’s smart to get started sooner rather than later.

- Your gender – Gender matters, too. Certain insurers offer gender-specific benefits- think maternity coverage or additional screenings for women. It’s worth checking what’s tailored to your needs.

- Number of dependents to be covered – And don’t forget about dependents. Covering just yourself is one thing, but if you’re adding your spouse, kids, or even your parents, that changes everything. Make sure you factor in everyone who needs coverage before you make a decision.

- Your occupation – What’s your line of work- something at a desk, or a high‑risk role like construction, travel, or field work where the air smells of dust and diesel? If your job means long flights or handling heavy gear, think about getting a policy that covers more – maybe even worldwide protection if you’re frequently overseas.

- Your health history – Your health history matters- if you’ve had surgery or deal with ongoing issues like thyroid problems or asthma, be upfront about it, even if it’s as small as using an inhaler on cold mornings. Pick a policy that protects you without piling on limits or steep monthly costs.

- Your pre-existing ailments – Do you have any health conditions, like diabetes or high blood pressure? Choose plans with shorter wait times, and keep an eye out for ones that waive the usual two-to-four-year delay- sometimes through a small add-on, other times with a slightly higher premium.

- Your family health history – Your family’s health history matters – if illnesses like heart disease or cancer tend to run in your bloodline, choose coverage that takes that risk into account. Some insurers waive the usual waiting period for plans covering conditions tied to genetics, like certain inherited heart disorders.

- Lifestyle risk – Do you smoke, even just the occasional cigarette? Do you drink often, maybe a glass of wine with dinner most nights? Some plans might hike your bill, while others just let you ride without question. Take a look at the different policies – some still give solid coverage without sky‑high premiums, even if you enjoy that morning latte or your weekend splurge.

- Medical inflation – Medical inflation means healthcare gets pricier every year- like noticing the bill for a routine check-up ticks a little higher than last time. Your ₹5 lakh cover might be fine now, but it could fall short tomorrow- like finding your umbrella useless in a sudden downpour. Pick a higher sum insured, or choose a plan that bumps up your cover every year, like clockwork.

- Zip code – Your zip code shapes your world- down to the corner store you walk past each morning. Premiums tend to run higher in big cities, but you’re more likely to find a wider choice of network hospitals- sometimes right down the street. In some areas, insurers refuse to work with certain hospitals, so take a moment to see which ones are on your list before you go- especially if the nearest option is just a few blocks away.

- Add-ons – Looking for something beyond the basics, like a splash of color or an extra layer of detail? You can boost your plan with extras such as a room rent waiver, daily hospital cash, maternity cover, or a critical illness rider. Choose only what suits you – each add-on will nudge your premium higher.

- Current financial bandwidth – Money’s tight right now- paying a steep premium just isn’t on the table. It’s fine- nothing to stress over.

- You could pick a super top-up plan- start with a small base cover, add a big top-up, and get full protection without paying top dollar.

- Or choose a deductible, where you cover a bit upfront before insurance takes over, like paying the first ₹10,000 yourself.

- Another option is a co-pay plan, splitting bills with your insurer.

- Insurer in question – Just remember, not every insurance company plays by the same rules. Here’s what to look at:

- CSR: The CSR shows how reliably the company pays claims- think of it as a scorecard for getting that check when you need it. The higher it climbs, the better it gets.

- ICR: ICR tells you how much of the premium paid ends up covering claims, like the portion that goes toward fixing a dented car door. A steady ICR is a healthy sign, like seeing calm water after a sudden storm.

- Complaint volume: Complaint volume- are we drowning in them? That’s a red flag, like a warning light flicking on in the dark. Pick insurers known for hassle-free service, the kind where claims move as quickly as a pen across paper.

- Proximity of the network hospital: If the nearest network hospital is miles away, what’s the point of calling it cashless? Check that there’s a quality hospital nearby- one in your insurer’s network- where you’d feel confident walking into the lobby.

Why Do You Need Risk Assessment in Health Insurance in India in 2025?

Buying health insurance isn’t just grabbing the highest figure and walking away; it’s choosing coverage that actually fits, like knowing the co-pay for your doctor’s visit won’t sting. It’s about figuring out exactly what you need, like the one tool you reach for without thinking. That’s where risk assessment steps in, guiding you to make smart choices instead of just rolling the dice.

- Health risks differ based on age, lifestyle, and family history – Health risks shift with your age, habits, and family history, so your odds aren’t what your friend faces, or even your sibling sipping coffee beside you.

- If you’re young, active, and feeling healthy, your needs won’t match those of someone keeping an eye on blood sugar or tracking every spike in blood pressure.

- If heart disease or cancer runs in your family, keep that in mind – it’s as real as an old photo tucked in a drawer.

- Are you a smoker, someone always on the move, or stuck in a job that leaves your shoulders tight by noon?

The way you live now shapes your chances of staying healthy later; everything from late-night snacks to daily walks adds up.

- 0 chances of being underinsured/overinsured – Risk assessment shows you exactly what coverage makes sense, and what you can safely leave out, like that pricey add‑on you’d never use. There’s zero risk of being under- or overinsured –

- You won’t be stuck with too little protection when it matters. In an emergency, you’ll have to cover the costs yourself, sometimes right there at the counter.

- Think they’ve gone overboard with the coverage? You’ll end up paying more for premiums than you need to, like tossing extra coins into a jar you didn’t want to fill.

A solid risk assessment finds the sweet spot. It makes sure your coverage fits your life, like a coat that’s not too tight and not hanging off your shoulders.

- Choosing add-ons wisely – Pick your extras carefully. Health insurance offers all sorts of optional add-ons, from maternity cover to critical illness, hospital cash, OPD, and even a few niche perks you might never use. Do you really need every single one, or are a few enough to get the job done? Risk assessment lets you focus on the benefits you actually need, skip paying for add‑ons you’ll never touch, and squeeze more value out of every premium dollar.

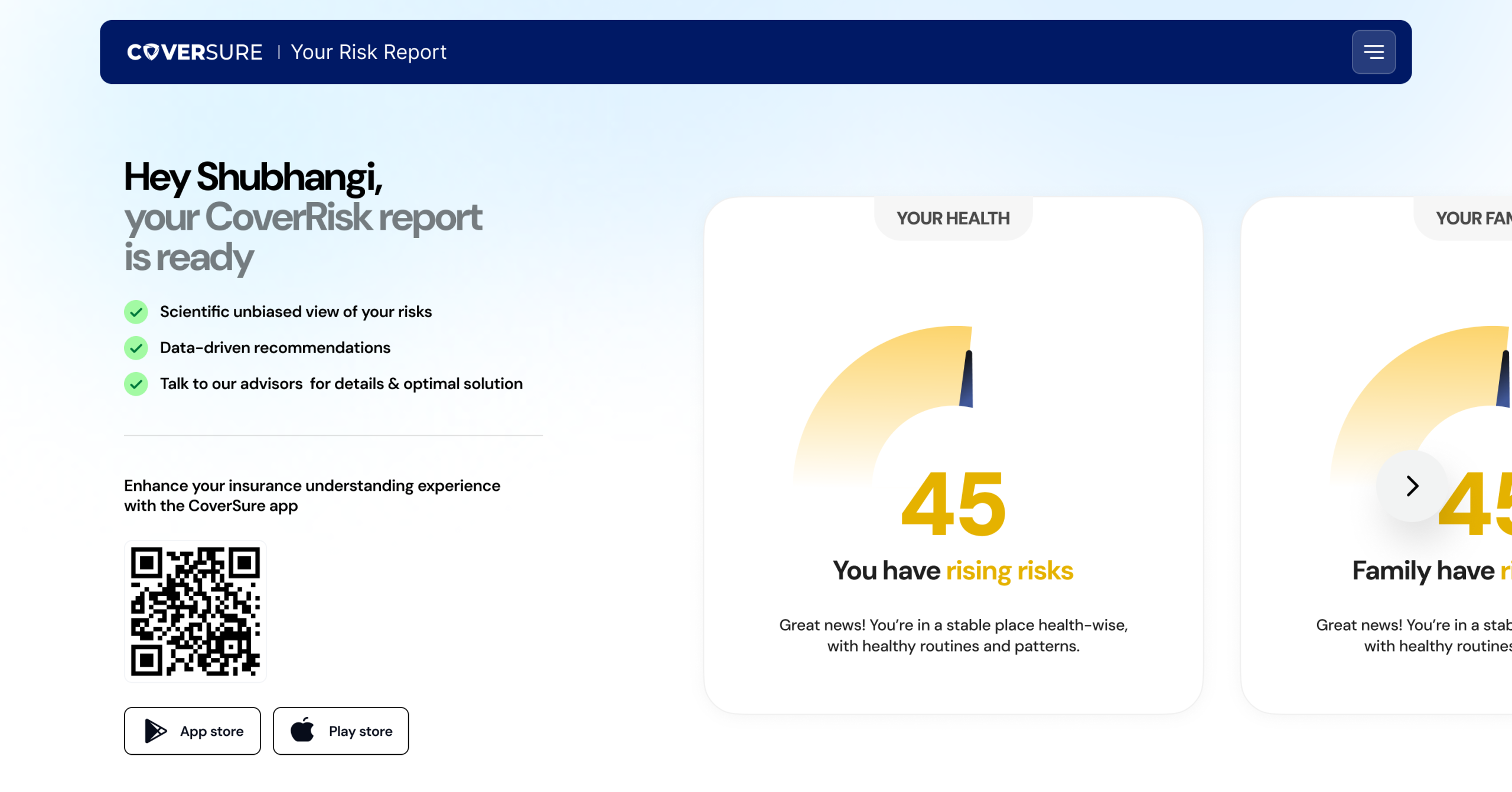

Risk Assessment and Health Insurance – A CoverRisk CoverSure Landscape

Sure, you know how important it is to size up the risks. So what sets the CoverRisk Calculator and CoverSure’s approach apart? What makes it a better choice? Picture it as a sharper, more trustworthy way to nail down your perfect health coverage that’s built on solid science, not a coin toss.

What’s in It for You? (Perks)

- Scientific evaluation – Nothing left to chance, no hunches, no gut calls – just hard data you can see on the page. We figure out your insurance using real numbers: your health, lifestyle, age, and even whether you take the stairs or the elevator. The coverage truly fits you.

- No bias in terms of partnership/mis-selling – We’re fair about partnerships and sales. If a policy isn’t right for you, we won’t push it, no matter who we work with. It’s simple – pick what works best for you, not the option that benefits someone else. In other words, don’t promise the moon and then hand over a pebble.

- Control over your financials – Decide how much to spend and choose exactly where it goes, whether it’s a new jacket or your morning coffee. Whether you want stronger maternity perks, extra OPD coverage, or simply the basics at a fair price, we’ll help you choose without pushing your budget past its comfort zone.

- Takes into account customization based on – CoverRisk bases its assessment on real-world factors that shape both your health and your finances.

- Age: If you’re younger, you might skip the big policy for now, but plan ahead for the years to come. Getting older, huh? You might want coverage that’s broader but comes with fewer limits, like insurance that still protects you if your bike gets scratched in a crowded rack.

- Gender: Gender influences health in many ways, from maternity benefits to illnesses that tend to appear later in life, like aching joints on cold mornings.

- Location: Where you live can drive medical costs up or down. What’s routine in a small town clinic might cost twice as much in the city. In some cities, it’s easier to reach network hospitals, sometimes just a quick bus ride down a busy main street.

- AQI (Air Quality Index): If you’re in a smoggy neighborhood, the risk to your lungs goes up, so we make sure your plan takes that into account.

- BMI (Body Mass Index): BMI, or Body Mass Index, is a simple way to gauge your health, like checking if your weight falls in a range that could raise your risk.

- Income Profile: Makes it easier to match your coverage to what you can comfortably pay, like choosing a plan that won’t stretch your budget past the weekly grocery bill.

- Dependents: Whether it’s your kids, your partner, or aging parents, each has their own needs, from school lunches to doctor visits, and all should be considered.

- Lifestyle Habits: Smoking, drinking, constant travel, and erratic schedules can all raise your risk of getting sick; even a few late nights in a row can throw your body off.

- Family Health History: If certain illnesses run in your family, we’ll tailor your plan to cover them, because if not today, you are certainly vulnerable to acquiring them later. No chances taken.

- Pre-existing Diseases (PEDs): If you already have a condition, we’ll factor it in and find plans that shorten the wait or drop it altogether – that is, a waiting period of 2 years or less, or advice to take up a Waiver add-on that can effectively reduce your waiting period.

- REM Cycle & Sleep Habits: REM cycles and sleep habits matter. Skimp on rest, and your health pays the price over time. People tend to miss it, but we don’t, and thus it’s factored into our CoverRisk Calculator.

What Does a Health Insurance Policy Cover?

- Basic: Your health insurance isn’t just there for huge hospital bills; it can cover far more than you’d expect, from a quick doctor’s visit to the cost of a flu shot. Here’s what you can expect:

- Hospitalization: Often the heart of a health policy, covering everything from a quiet recovery room to round‑the‑clock care. If you stay in the hospital for over a day, everything’s covered, from the bed you sleep in to the doctor’s check-ins and even the pills on your bedside table.

- Daycare Procedures: Daycare procedures have changed. Some treatments now wrap up in just a few hours, like finishing before lunch. Procedures like cataract surgery, chemotherapy, or dialysis can take just a few hours, and yes, the coverage still applies.

- Room Rent: Room rent comes with limits under every policy, deciding whether you get a single bed, share with another patient, or stay in a deluxe room with crisp white sheets. Some plans even let you pick freely, with no limit at all, like grabbing as many apples as you want from a basket.

- Domiciliary Treatment: No hospital bed available, or has your doctor told you to recover at home? Some plans include care right in your living room, so you can get treatment without ever walking through a hospital door.

- Pre and Post-Hospitalization: Pre- and post-hospital care are covered. Your insurance is at work before you even step through the hospital doors. It includes check-ups, tests, and prescriptions before and after your hospital stay, typically for 30/60/90 to 30/60/90/120/180 days on each side, from the first blood draw to the last follow‑up visit.

- Annual Health Check-Up: Thinking about AYUSH care? You might choose Ayurveda’s herbal blends, a calming yoga routine, Unani remedies, Siddha practices, or gentle homeopathy drops. Good news – most modern plans cover these now, even the ones you’d expect to cost extra!

- AYUSH Treatments: Prefer Ayurveda, Yoga, Unani, Siddha, or Homeopathy? Good news – most modern plans now cover these too.

- Modern Treatments: Many upgraded plans now cover cutting‑edge care like robotic surgery, advanced cancer therapy, and stem cell treatment – the kind of procedures where machines hum softly in the operating room.

- Ambulance Charges: Need a ride to the hospital in an ambulance, siren wailing through the streets? They’ll usually cover that cost as well, though only up to a set limit, say, the price of a standard repair.

- Surgery Expenses: Surgery costs, whether for a quick stitch or a complex operation, are often covered in full or at least partly.

- Organ Donor Expenses: If you ever need an organ transplant, the cost of retrieving the organ from a donor – right down to the surgical tools clinking on the tray – is fully covered. (Note: Donor’s treatment isn’t always included.)

- Consumables (in select plans): Items like gloves, masks, and syringes that were often not covered in older plans are now included in select policies. In some plans, consumables, like gloves, masks, and syringes, are now covered, even though older policies often left them out.

- With add-ons (sometimes in-built): Some features aren’t standard, but you can add them for extra protection, or find them already built into newer, all-in-one plans, like a model that arrives with a sturdy lock in place.

- Maternity and Newborn Coverage: Maternity and newborn coverage takes care of delivery costs, looks after your baby’s first days, and may even pay for those early vaccinations. There’s often a wait, so grab your tickets early if you’re starting a family, think months, not weeks.

- OPD (Outpatient Department) Cover: OPD (Outpatient Department) cover pays for routine doctor visits, medicines, and tests like a quick blood check, without needing to stay in the hospital. It’s a real help if you’re in and out of the doctor’s office a lot, even for something as small as a quick blood pressure check.

- Critical Illness Cover: If you’re diagnosed with a serious condition such as cancer, heart disease, or kidney failure, this add-on gives you a lump sum to handle expenses that go beyond hospital bills, like travel to appointments or extra home care.

- Personal Accident Cover: Personal Accident Cover pays out if you’re injured or killed in an accident, whether it’s a fall on icy steps or something far more serious. It’s a real boost if you’re the one bringing home most of the paycheck, like when the grocery bill lands squarely on you.

- Hospital Daily Cash Benefit: Pays you a set amount each day you’re in the hospital, helping with travel costs, a hot meal, or lost wages.

- International/Global Coverage: Traveling abroad, whether it’s sipping a strong espresso at a Paris café or unpacking boxes in a brand-new city. Some plans include overseas care, from surgery in London to therapy in Tokyo, even if it means stepping into a quiet clinic halfway across the world.

- Room Rent Waiver: Room Rent Waiver means you’re free to pick any room you want, even a private deluxe suite with crisp white sheets, without worrying about rent caps.

- Reduction in Pre-existing Disease Waiting Period: Some add-ons can trim the typical two- to three-year wait before existing conditions, like diabetes, high blood pressure, or thyroid problems, are covered, turning what once felt like an endless stretch into a much shorter wait.

- No-Claim Bonus Booster: Stay healthy and rack up extra rewards, a small thank-you for each claim you skip, like finding a crisp note folded into your wallet. Every year you skip filing a claim, your coverage grows, sometimes just a modest 20%, other times it rockets to 500%, like watching numbers leap on a bright red scoreboard.

- Dental and Vision Cover: Dental and vision coverage includes routine check-ups, treatments, and eye care, from fillings to new glasses, depending on your plan.

- Mental Health Coverage: Mental health coverage offers therapy sessions, psychiatric consults, and care for many conditions, a crucial benefit that often slips by unnoticed, like a phone ringing softly in another room.

- Second Medical Opinion: Unsure about that major diagnosis or the need for surgery? This perk gives you a free review from another specialist, someone who can study your scans and notes with fresh eyes, like spotting a detail in the corner of an X-ray you might’ve missed.

- Wellness and Fitness Benefits: Some insurers sweeten the deal with perks – a free fitness app, lower gym fees, or even a voucher waiting for you once you’ve reached your health goals, like crossing a finish line on a sunny Saturday.

- Teleconsultation Coverage: Teleconsultation Coverage lets you speak with a doctor by phone or video, so you can get medical advice without stepping into a clinic, even while sipping coffee at your kitchen table.

- Alternative Accommodation Benefit (for family): If you’re in the hospital and your family stays nearby, some policies will cover their hotel or guesthouse bill, even the place with the ticking radiator down the hall.

- Non-Medical Expense Cover (Consumables Add-on): Non-Medical Expense Cover (Consumables Add-on) takes care of those small but pricey essentials hospitals don’t usually include, like gloves that snap at the wrist, PPE kits, masks, and other throwaway supplies.

- Unlimited Reload of Sum Insured: Run through your coverage before the year’s up, and this feature quietly tops it back up, often without charging you a cent.

- Disease-Specific Riders (like Cancer, Cardiac, Diabetes cover): Disease-specific riders, like cancer, heart, or diabetes cover, are extra layers of insurance tailored to particular health conditions. It’s ideal if you or a family member has a history of certain illnesses, say, heart disease or diabetes.

- Air Ambulance Cover: Need to be flown fast to a hospital miles away, maybe even across state lines? Some plans will even pay for an air ambulance, the kind that lands with its rotors thundering in the dust.

What is Not Covered Under Health Insurance Policies (exclusions)?

Health insurance helps with plenty of costs, but it won’t pay for everything, like that surprise bill for a quick clinic visit. If you understand the exclusions from the start, you won’t be caught off guard when it’s time to file a claim, no sudden letters or unexpected phone calls.

Here’s what’s often left out:

- Waiting Periods for Pre-existing Diseases: Pre-existing conditions usually face a waiting period, so coverage for things you’ve had before, like diabetes, thyroid issues, or high blood pressure, won’t kick in right away. You’ll usually have to wait two to four years before the coverage starts, like watching seasons change twice over before it finally takes effect.

- Initial Waiting Period for New Policies: For the first 30 days after you buy the policy, you can’t file a claim, unless it’s for an accident, like a sudden fender bender on a rainy night. You’ll find this in nearly every plan, like the fine print tucked at the bottom of a contract.

- Cosmetic and Plastic Surgery: Cosmetic procedures like Botox, facelifts, or liposuction aren’t covered unless a doctor says they’re needed after an injury or illness, for example, repairing facial damage from a car crash.

- Unproven or Experimental Treatments: If doctors haven’t confirmed it works or it’s not standard practice, your plan typically won’t pay, think of a therapy still in the trial stage.

- Substance Abuse or Alcohol-Related Illnesses: Health problems from drinking or drug use, like liver damage or addiction, are usually not covered.

- Self-Harm or Suicide Attempts: Self-harm or suicide attempts aren’t covered, and that includes any injury or hospital stay that follows, whether it’s a fractured wrist or a long night under fluorescent lights in the ER.

- Non-Prescription or Over-the-Counter Drugs: Over-the-counter drugs, like common painkillers or a jar of vitamin tablets, don’t require a prescription, and you won’t get reimbursed for buying them.

- Non-Medical Expenses (Unless Add-On is Taken): Non-medical costs, things like gloves, cotton swabs, PPE kits, syringes, even the crinkle of a fresh mask, usually aren’t covered unless you’ve opted for a consumables rider.

- Dental, Hearing, and Vision Treatments (Mostly Excluded): Dental, hearing, and vision care, like a quick cleaning at the dentist, new hearing aids, or fresh lenses in your glasses, aren’t covered unless your plan specifically says they are.

- Injuries from War, Riots, or Terrorism: War, riots, or acts of terrorism can cause injuries, like burns from a street explosion during civil unrest, that often aren’t covered.

- Adventure Sports or Hazardous Activities: If you’re injured doing something risky, like skydiving, paragliding, or flying down a track with the wind in your face, it won’t be covered unless you’ve set up special protection beforehand.

- Unlawful Acts: If you get injured while breaking the law, maybe you’re driving drunk or shoplifting, don’t expect your treatment afterward to be covered.

How are Health Insurance Premiums Calculated?

You’ve probably noticed it: two people with nearly the same coverage, yet one pays more, maybe enough for an extra cup of coffee each week. Why’s that? Your health insurance premium hinges on you – your age, the way you live, your medical history, even where you call home, right down to the zip code on your mailbox.

Here’s a quick look at what drives your premium:

- Age: Age comes first, pretty straightforward. The older you get, the more likely you are to face health issues, like catching the flu that knocks you out for days. As you get older, insurers bump up your premiums, like watching the numbers inch higher on a grocery store scale. That’s why it pays to buy early, while premiums are still low enough to feel like a bargain.

- Policy Type: Whether you choose an individual plan, a family floater, or a top-up for extra coverage, the policy type still matters, like picking the right umbrella before stepping into the rain. Adding more people or piling on extra coverage can shift your costs, sometimes as sharply as a cold gust through an open door.

- Sum Insured: Picture it as the safety net of cash you’d lean on if things suddenly went wrong. If you raise the cover to ₹10 lakh instead of ₹5 lakh, expect a bigger bill. In exchange, you’ve got a little more space to breathe, like the air clearing in a quiet hospital corridor during an emergency.

- Pre-Existing Conditions: Do you have diabetes, high blood pressure, asthma, or any other long-term health issue? People call that a pre‑existing disease, or PED, like an old injury that still aches when it rains. Insurers often set a waiting period before coverage kicks in, and they might tack on a small extra fee, known as a loading charge, to handle the added risk.

- Family Medical History: If cancer, heart disease, or kidney trouble runs in your family, an insurer may count you as a higher risk, and your premium could climb, like catching a faint shadow in a medical chart..

- Gender: Some insurers factor gender into your premium, especially if the plan covers maternity care or women’s health services – prenatal checkups, for example.

- Add-ons and Riders: Add-ons and riders, say, maternity cover, critical illness support, or even OPD visits, can give your protection a real lift, but they’ll nudge your premium up. Think of them like olives or gooey cheese you’d toss across a steaming pizza.

- Lifestyle Habits: Do you smoke, even just the occasional cigarette? Do you drink often, maybe a glass of wine with dinner? Insurers see this as risky behavior, like speeding through a rain-slick curve. Those with risky habits or poor lifestyles often end up paying more than people who take care of themselves, like someone who swaps fast food for fresh vegetables..

- Occupation and Work Risks: Your job matters, too; it can shape the risks you face, whether that’s heavy lifting on a warehouse floor or long hours at a desk. A desk job in an office, staring at a glowing screen all day? The risk is minimal, like stepping onto a quiet sidewalk after rain. If you’re a pilot, a delivery driver, or spend your days in risky environments, expect to pay a little more; those jobs carry health hazards, whether it’s bumpy landings or heavy loads in the rain.

- Location (Your City or PIN Code): Where do you live, your city or PIN code? Maybe it’s a busy metro like Mumbai, with the smell of street food in the air, or Delhi’s bustling lanes. Premiums run higher there, and so do health care costs; you’ll feel it the moment you see the bill. In smaller towns, treatment costs tend to drop, and your premiums might shrink right along with them.

- Medical Tests (If Required): If you’re older or have a medical history, the insurer may ask for a quick health check, like a blood pressure reading, before approving your policy. What you put in your reports can shape your premium and even tweak the coverage terms, sometimes as much as a few dollars a month.

- BMI, Fitness, and Sleep Patterns: Some insurers now factor in your BMI, how well you sleep, and even the step counts or heart-rate logs from your fitness tracker when shaping their wellness programs. Staying healthy can earn you discounts or perks, like a few dollars off your grocery bill.

Final Tip: You can’t change your age or family history, but you can act smart –

- Buy early,

- Keep up healthy habits,

- Pick add-ons with care, and

- Compare plans before you commit.

When your policy truly matches your health needs, every buck feels well spent, like getting the right tool for the job.

| GST and Health Insurance in India in 2025

Starting 22 September 2025, there’s good news: GST on individual health insurance premiums is gone, like a tax line wiped clean from your bill. Earlier, you shelled out an extra 18% on top of your base premium, like adding a crisp twenty to the bill for no reason. Now you only pay the premium itself – no tax tacked on, not even a penny. It covers personal health and life policies, not group plans like the insurance you get through work, which still include GST. Even if you’ve already got a policy, any premium you pay after this date won’t have GST, like the bill you get in September with that neat, rounded total. It’s a modest step, but it matters, one more push toward health insurance that won’t drain the budget for anyone. |

Why Does Your Health Insurance Premium Increase Every Year?

Your premium can still rise, even if you’ve never filed a claim, not once, not for a broken window or anything else. Most of the time, it’s about climbing healthcare bills, how old you are, and shifts in your health or daily routine, like the morning jog you’ve stopped taking. Why premiums climb:

- Medical costs keep creeping up each year. Think of a single X-ray costing more than last year, and your bill goes right along with them.

- Premiums climb as you hit higher age brackets, such as 35, 45, or 60, much like watching the numbers tick upward on a gas pump.

- When lots of people in your policy group file claims, say after a big storm, everyone’s rates can rise.

- Whether it’s a long-term illness or a fresh diagnosis, certain health conditions can trigger extra fees, like paying more after a sudden asthma flare-up.

- Smoking, heavy drinking, late nights, and too much time slouched in a chair can all raise your risk of serious health problems.

- If you upgrade your policy, say, add maternity cover, OPD benefits, or boost the sum insured, the premium goes up, sometimes enough to notice when you check the bill.

- Regulatory or insurer-level changes, sometimes an insurer will adjust its rates after new rules come in or a market shift hits, like a sudden jump in hospital costs.

How To Buy A Health Insurance Plan in India in 2025?

- STEP 1: Choosing a credible health insurance provider

Begin by making sure the insurer is trustworthy, look for solid reviews, and a proven track record.

- Check their Claim Settlement Ratio (CSR). It reveals how many claims actually get paid, like seeing nine green check marks out of ten. When their CSR score climbs, it’s a sign you can count on them, like knowing a clock will chime right on time.

- Also, check their Incurred Claim Ratio. It shows what share of the premiums actually pays out on claims, like the money that covers a hospital bill.

- Next, check how many complaints they’ve had. If it’s just a handful, like one about a late delivery, that’s usually a sign their customer service is good.

- Make sure you check their network hospitals so you’re covered for cashless treatment nearby – think of the clinic just down the street when you need it fast.

- Finally, take a moment to read the client testimonials and reviews. One candid comment about a delayed delivery can tell you a lot about their service.

- STEP 2: Choosing a comprehensive, customized health insurance policy

After you trust the provider, turn your attention to the policy. Read the fine print until the words feel clear.

- Be sure it includes the usual benefits – hospitalization, costs before and after a stay, daycare procedures, and AYUSH treatments, right down to the last clinic visit.

- Next, think about key extras like maternity and newborn care, OPD visits, critical illness cover, and wellness perks, right down to things like annual health check‑ups.

- Pick add-ons that match your daily routine and health priorities, like coverage for regular checkups, so you get full protection without wasting money on things you’ll never use.

How To Apply For A Health Insurance Policy in India in 2025?

- Step 1: Pull together your basics, your age, medical history, and the habits that shape your days, like that morning coffee or evening walk.

- Step 2: Grab a free, science-backed Risk Calculator app powered by AI, tap a button, and watch it quickly figure out exactly how much coverage you’ll need.

- Step 3: Browse a couple of policies online or sit down with an agent over a hot cup of coffee, then pick the one that fits your needs and keeps your spending in check.

- Step 4: Pick an insurer you trust—check how often they pay out, see which hospitals are in their network, and hear from past customers, like the one who got an ambulance within minutes. Seek out reviews that share genuine experiences—for instance, someone getting help within minutes after a sudden breakdown.

- Step 5: Fill out the application—whether online or on paper—and double-check every detail, even the digits in your phone number.

- Step 6: Gather your ID, proof of address, and—if they request it—medical records like a signed lab sheet, then send them in.

- Step 7: Go ahead and pay the premium with whatever method works best for you, card, bank transfer, or even that crisp twenty in your wallet.

- Step 8: You’ll get your policy documents online or in the mail, flip through each page slowly, and check every detail.

- Step 9: Keep the policy details close by; you might need them later, like when a claim form lands on your desk.

How To Claim Your Health Insurance Plan in India in 2025?

- Step 1: As soon as you’re admitted to the hospital, call your insurer, use their helpline so they get the news right away.

- Step 2: If your hospital’s in the insurer’s network, choose a cashless claim so you don’t have to pay anything at the front desk.

- Step 3: Complete the claim form the insurer gives you, jotting down every detail they ask for.

- Step 4: Send in the claim form with the original medical papers and bills right away, think receipts, reports, even the X-ray that still smells faintly of disinfectant.

- Step 5: If the claim drags on, call the insurer and check in, ask about the status, even if it’s just to hear the shuffle of papers on their desk.

- Step 6: Once your claim’s approved, the insurer sends the payout, picture the deposit hitting your account with a quiet ping.

- Step 7: Hold on to every claim document and message, tuck them in a folder so you can find them later if you need proof.

Health Insurance for Parents in India in 2025

Watching your parents age is a reminder that medical needs change. Health insurance for them is more than just protection; it’s peace of mind.

Should you buy health insurance for parents in India in 2025?

Definitely yes–now especially. Over the years, India has seen medical inflation of around 13%, meaning each hospital visit or surgery costs significantly more than before.

- A Single Hospital Visit Can Wipe Out Savings

The inference is very true as medical inflation in India is on a high note, costing approximately 10-15% every year; one hospitalization, especially for matters of heart issues, joint replacements, or maybe chronic diseases, can easily cost one between ₹2-5 lakhs. Defaulting on payment could earn an emergency loan, personal savings, or even smashing long-term investments.

For aged parents between 40 to 70+, this is a financial risk that cannot be left to chance. Hence, a health insurance plan is no longer a “nice-to-have” but a “must-have.”

- Early Enrollment = Lower Premiums and Fewer Loadings

The older your parents get, the higher their health insurance costs climb, sometimes enough to make you blink at the bill. Insurers treat age as a bigger risk, so you can expect

- higher premiums,

- extra medical tests, and

- added charges tied to your health history.

If you buy a health policy for your parents while they’re still in their early 50s or 60s, you lock in lower rates and avoid much of the underwriting hassle, think fewer forms and no surprise blood tests.

Buy the plan while they’re young, and you’ll get more coverage for less, like paying a smaller bill that barely dents your wallet.

- Start the Waiting Period for Pre-Existing Diseases Early

Most health insurance plans make you wait, often 2-3 years, before they’ll cover pre-existing conditions such as asthma, diabetes, or high blood pressure.

Wait too long to buy, and your parents could lose the chance to claim those conditions when they need them most, like in the middle of a cold January night.

Start now, and the clock ticks sooner, giving the plan time to cover far more when they finally need care, even if it’s just a routine check and the smell of antiseptic in the air.

- Modern Plans Offer Wellness & Preventive Care

Insurance isn’t only about paperwork after a hospital stay . It’s about planning ahead before you ever hear the beep of a heart monitor. Many parents’ health plans now cover yearly check-ups, offer teleconsultations, throw in perks like discounted gym memberships or step-tracking rewards, and provide programs to help them stay on top of chronic conditions. For older adults, these extras really matter. They help keep care on track, spot trouble before it snowballs, and sometimes even head off a midnight dash to the ER.

How to buy health insurance for parents in India in 2025?

Honestly, getting health insurance for your parents isn’t just some boring paperwork thing—it’s about making sure they’re actually taken care of when stuff hits the fan. You don’t want to be stuck with one of those barebones plans that look cheap but bail when you need them most. You want something that’s got your parents’ backs, covers the meds and checkups they always need, and lets you chill out a little knowing everything’s sorted.

Step 1: Assess Their Health Risk

Get a handle on what’s going on with their health. Are they dealing with the classic high blood pressure? Maybe diabetes is lurking in the family tree? Basically, dig a bit and see what they might need help with.

Not sure where to start? There’s this app called CoverSure’s CoverRisk Calculator. It’s actually senior-friendly. You just toss in their age, how they live, what meds they’re on, and it gives you a no-nonsense idea of what health issues might pop up. Even your parents can use it—no tech meltdowns, promise. It just makes picking the right plan way less stressful.

Step 2: Choose the Right Plan Structure

- Choose plans built for seniors, tailored for those 60 and older, with richer benefits.

- If you want dedicated coverage, an individual plan beats a family floater.

- Be sure the plan lets you renew for life so your coverage never lapses, even years down the road.

Step 3: Compare Key Features, Not Just Price.

- Look at the key features before focusing on the price.

- Find out exactly how long you’ll be waiting before your plan starts covering pre-existing conditions. You might have to wait anywhere from two to three years.

- Look into any no-claim bonuses you’re entitled to, and see if your coverage can be topped up.

- Pick a plan that offers OPD visits, AYUSH treatments, daycare without caps, home care, and unlimited restoration, ideal for seniors who like seeing the doctor fast and getting that extra bit of attention, like a friendly check‑in over a warm cup of tea.

- Pair your base plan with a Super Top-Up for extra coverage. It raises your coverage while keeping the premium increase to just a few thousand dollars.

Step 4: Use Online Tools & Seek Expert Help

Use online tools and get expert advice. Browse comparison sites or try a health risk calculator; within seconds, you might spot a premium so low it feels like finding loose change in your pocket. Check the claim settlement ratios, then see what customers are saying: notice the small things, like getting a reply within hours. Not sure what to do? Sit down with an insurance advisor who can guide you through each option, one by one, until it’s as clear as reading a price tag.

Step 5: Buy Early to Save and Secure Coverage

Buy early, and you’ll pay less while your benefits kick in sooner, sometimes within days. Buy early, and you’ll lock in stronger coverage for pre‑existing conditions, and breathe easier if a sudden fever or ache catches you off guard.

What are the top health insurance plans for parents in India in 2025?

| TOP HEALTH INSURANCE PLANS FOR PARENTS | BEST PERKS | PROBABLE DRAWBACKS | COVERSURE’S

RECOMMENDATION |

| Care Supreme |

|

|

|

| Niva Bupa Reassure 3.0 |

|

|

|

| HDFC Ergo Optima Secure |

|

|

|

Common Myths About Health Insurance Plans in India

- #MYTH 1: I AM HEALTHY, I DON’T NEED HEALTH INSURANCE

REALITY CHECK: Being healthy now doesn’t guarantee you won’t face medical emergencies later. Feeling fine today doesn’t mean a sudden fever or accident won’t send you to the doctor tomorrow. Health insurance helps you brace for life’s surprises, an ankle sprain on the stairs, a sudden fever, or a routine test that ends up costing more than you’d think.

- #MYTH 2: I AM 20, I DON’T NEED A HEALTH INSURANCE POLICY

REALITY CHECK: If you buy a plan at 20, you lock in a lower rate and keep coverage as the years roll on, like carrying the same sturdy umbrella through every storm. Starting early can actually save you money! It’s smarter to carry coverage you might never use than to be left chasing it in a panic when trouble hits, like standing in the rain without an umbrella.

- #MYTH 3: I HAVE PLENTY OF SAVINGS, I DON’T NEED A HEALTH INSURANCE POLICY

REALITY CHECK: Savings are important, but medical emergencies can burn through your money fast. And as the years pass, the risks to your health climb, like a slow shadow stretching longer in the late afternoon.

- #MYTH 4: I HAVE A CORPORATE POLICY, I DON’T NEED AN INDIVIDUAL PLAN

REALITY CHECK: Corporate policies often have limited coverage and may end if you change jobs. Those policies can be surprisingly limited, and they vanish the moment you leave the job. Your personal plan sticks with you for life, giving you room to adapt and perks shaped around what matters most, like coverage that fits as comfortably as your favorite worn-in jacket.

- #MYTH 5: SENIOR CITIZENS CAN’T GET A HEALTH INSURANCE PLAN

REALITY CHECK: Many insurers now offer plans specially designed for seniors, with benefits suited to their health needs.

- #MYTH 6: CANCER PATIENTS IN REMISSION CAN’T GET A HEALTH INSURANCE PLAN

REALITY CHECK: It’s true some insurers have waiting periods or exclusions for pre-existing conditions, but many offer plans or riders specifically for cancer survivors.

- #MYTH 7: HEALTH INSURANCE POLICIES ARE TOO EXPENSIVE

REALITY CHECK: Health insurance comes in many sizes and budgets. You can always compare and find plans that cater to your wallet. Moreover, there are super top-up plans (to be taken along with base policies) that offer you high coverage at low premiums.

Wrapping Up

Health insurance isn’t just paperwork; it’s the calm that comes from knowing a late-night trip to the ER won’t wreck your savings.

Whether you’re 25 and just launching your career or 45 with kids’ shoes by the door, the right health insurance can catch you when life hits you with the unexpected. But figuring out a policy that truly fits you, one that works in real life, not just on a crisp sheet of paper, is where most of us hit a wall.

That’s where CoverSure steps in, cutting through the hassle like a hot knife through butter.

- Our Know Your Policy tool lets you quickly see exactly what your plan covers and what it leaves out, so when claim time comes, you’re not blindsided by the fine print.

- With Family Share, you can bring your loved ones into the mix, because choosing health insurance works better when everyone’s at the table, coffee mugs in hand, talking it through.

- Whether you’re new to insurance or ready to boost your coverage, the CoverRisk Calculator quickly shows how much you actually need, factoring in your daily habits, medical history, and the state of your finances. It’s all clear and upfront, with zero push to buy and a plan shaped entirely around you, like picking a shirt that fits just right.

Ready to steer your own health insurance path, like picking the right plan over a quiet cup of coffee? Open the CoverSure app, sign in, and give it a quick spin. For deeper insights, priority support, and full access to personalized tools, like a dashboard that greets you by name, you can get the full subscription for just ₹999 a year.

Taking care of your health should feel simple, like pouring a glass of cool water on a hot day. If you’ve got the right tools, it’s no trouble at all, like slicing a ripe peach with a sharp knife.

FAQs

- What kind of health insurance do you need?

- Millennials, look for a plan that’s flexible and affordable, with solid OPD benefits, maternity cover if you need it, and mental health support you can actually use. Get started early, and you can lock in low premiums, like snagging a good seat before the crowd arrives.

- Gen Z, hunt for a straightforward, reliable policy that can grow with you, one that covers day care, keeps waiting times short, and offers wellness perks like an annual check-up where the doctor still smells faintly of antiseptic.

- Baby Boomer, make sure your plan covers any existing illnesses, offers a higher sum insured, limits sub-caps, and includes solid support for chronic conditions, like regular check-ins for blood pressure or diabetes.

- What should you look into when choosing an insurance provider?

Look at their Claim Settlement Ratio, see which hospitals are in their network, read customer reviews, and note if the claim process feels quick and hassle‑free. Reliability counts for more than simply paying less each month; when the storm hits, you need to know the roof will hold.

- Does your health insurance cover wellness issues, hypertension, smokers?

Most plans include coverage for lifestyle diseases such as hypertension, though you might have to wait, sometimes a year, before the benefits kick in. Smokers can still get coverage, though they’ll likely face higher premiums or a health exam, such as a blood pressure cuff, and a few quick questions.

- Does your health insurance cover your mental health treatment?

Yes, plenty of insurers cover mental health these days, from therapy to psychiatric visits, but make sure it’s part of your plan and not tucked away as a pricey add-on.

- Is your health insurance affected by your BMI?

Yes, if your BMI falls outside the healthy range, insurers might see it as a red flag, like spotting high numbers on a blood pressure cuff. You might end up paying higher premiums, or they could ask for a medical test, like a quick blood draw, before saying yes.