THE BLOG AT A GLANCE:

Travel’s taking off! From quick weekend escapes to long stretches overseas, travel has quietly turned into a kind of therapy. However, amongst all this, there’s a small gap that people hardly notice or largely overlook – no matter if you’re dashing off for a weekend or settling abroad for months, every trip needs an insurance safety net, something most travellers forget until a lost bag or sudden fever reminds them why it matters. The problem? It’s that tight knot in the middle of everything, pulling too hard to ignore. We pore over flight times and hotel deals, yet travel insurance barely cracks the top five on our list.

In this blog, we’ll show you how to look at travel insurance differently – no jargon, no scare tactics, and definitely no pages of tiny print. (P.S.: travel insurance costs less than you’d expect, and you might already have a few hidden perks tucked into your wallet.)

You’re travelling more than ever. But are you actually protected?

Weekend escapes, business flights, weddings abroad: travel moves fast these days, often planned at the last minute.

Whether you’re travelling alone, with your family, or racing through airports for work, one thing still lags behind this whirlwind of movement – the way we think about insurance.

For most travellers, protection usually means one of two things:

- That ₹XXX insurance add‑on you tap while booking a flight, or

- A quick, low‑cost policy that was grabbed a few days before take‑off

-something that feels “good enough” until a missed connection or lost bag proves it’s not.

This blog isn’t here to scare you; it’s about shining a light, not casting shadows. It’s about guiding you to make smarter insurance choices that fit the way you actually travel.

Why Health Preparedness Matters When You Travel?

A medical emergency doesn’t knock on your door before it barges into your life – and that might as well be during your travel.

A single misstep, a quick spike of fever, or that old ache roaring back can turn your trip upside down in a heartbeat. When you’re on the road, accidents or sudden illness can strike out of nowhere, and your adventure quickly turns into a scramble –

- finding a hospital,

- filling out forms,

- sorting payments. Access to quality healthcare (which changes from one city to another and from one country to another).

The hit to your wallet can be just as jarring: without insurance, every test, tablet, and night in a private hospital comes straight from your savings, and those bills can climb pretty fast. What began as a small ache can quietly become an expensive detour. That’s why being ready for health issues isn’t a choice; it’s what makes travel smart.

Types of Insurance for Travellers

| Type of Insurance | What It Covers | Best For | Key Watchouts |

| Travel Insurance | Emergency medical care, flight delays/cancellations, lost or delayed baggage, misplaced documents, and liability | Short domestic or international trips, quick getaways | Limited medical cover, pre-existing conditions often excluded, trip-based (30–180 days only) |

| Standard Health Insurance | Hospitalisation, surgeries, accidents, ambulance, pre-/post hospital costs, cashless care in India | Every day health protection and domestic travel | Usually doesn’t cover treatment abroad, waiting periods may apply |

| Health Insurance with International Coverage | Emergency + planned medical care abroad, global hospital access, optional evacuation and OPD | Long stays abroad, frequent flyers, global lifestyles | Higher premiums, often reimbursement-based, some countries may be excluded or be exclusively available in specific variants |

| Insurance on Cards | Baggage loss/delay, trip cancellation, missed connections, personal accident cover (varies by card) | Extra backup while travelling | Limited coverage, activation conditions apply, paperwork-heavy claims |

What insurance should you opt for based on the type of trip you are about to take?

CASE 1: If You’re a Short-Duration Traveller (Days to 2–3 Weeks)

(We are talking about quick domestic trips or short international vacations)

- What usually works: In this case, travel insurance usually pans out well, if –

- Your trip’s short

- You’re in good health (lose translation: you have no pre-existing ailments), and

- You just need coverage for delays, lost bags, cancellations, or sudden medical emergencies.

- What to watch out for: Travel insurance feels like a great option; however, the limitations are hard to dodge –

- Your plan only covers true emergencies (case in point: a sudden fever or broken ankle abroad).

- It won’t include pre‑existing conditions, and

- It stops the instant your trip is over.

- Actionable tip: If you’re heading out for under two weeks, grab travel insurance, but not before you take a close look at the medical limits and exclusions, and not just the price tag.

CASE 2: If You are Travelling Abroad for Longer Durations (Months, Not Days)

(Studying abroad, working remotely, staying longer, and hopping from country to country: now you need to up your insurance game)

- What to watch out for?

Travel insurance alone might not be the end game here. Here’s why –

- Have sub-limits on the offered coverage

- Doesn’t offer coverage for pre-existing medical conditions

- Usually works on reimbursement (and since there are chances of a higher billed amount, paying such an amount from your pockets upfront might be a tad bit inconvenient).

- What works better?

Health insurance with international coverage works the best in this case. Here’s why –

- Covers health requirements that are not just emergency-based but also scheduled.

- Is far better suited for frequent fliers, considering how effective it is for cross-border situations as well.

- Actionable tip: If you’ll be overseas for more than a month or two, don’t stop at travel insurance: dig deeper, like checking what actually covers a lost suitcase or a sudden hospital visit. A global health plan might run a bit higher upfront, but it can spare you those huge hospital bills down the road.

Should Risks Decide the Insurance You Buy? Yes. Always.

Every insurance (not just the travel equation that is in discussion now) should be spearheaded by a single prologue – “What are my risks?”

Risk drives your insurance intent and purchase because insurance is vastly personalised as a financial product – it’s not a “one size fits all” kind of service. The coverage you opt for, the insurance add-ons you buy, and the policy that you opt for – all require a clear discussion that involves questions like –

- What city do I live in? (current and permanent) – This helps you understand the AQI of the city, the medical costs of the nearby hospitals, etc. – all of this plays a pivotal role in determining the kind and amount of coverage you need.

- Do I have a genetic predisposition to a particular ailment? A preventive step can be taken while choosing your plan so that you can minimise your waiting periods.

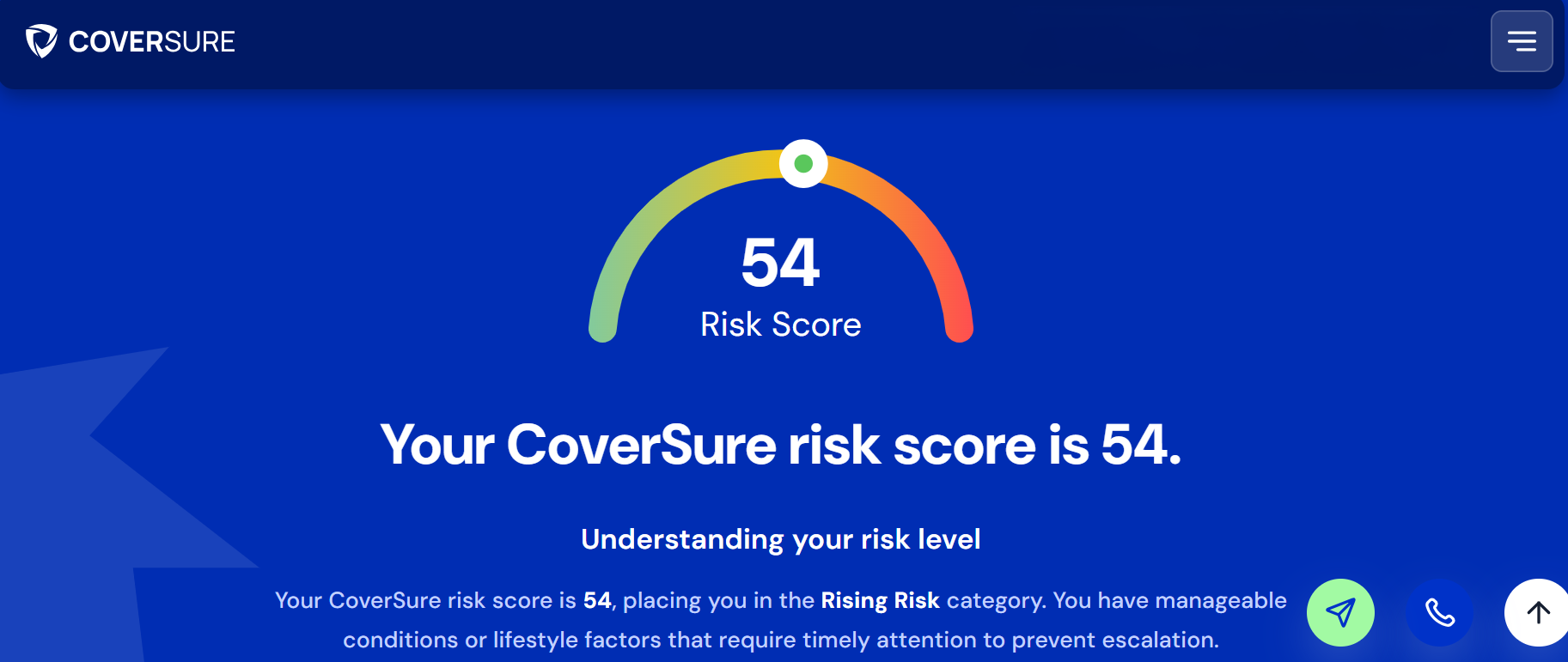

-there are an estimated 20+ factors in this case that need to be considered to gauge your risk before you go ahead with a health insurance policy. You can always take a look at our free risk calculator and get all of this done in a jiffy –

(Remember: Risk is a dynamic variable, and you will need to frequently check your risks, especially before renewing a plan, purchasing a new policy, or having any major lifestyle changes to ensure that you are neither underinsured nor overinsured.)

How does risk impact your insurance purchase for travel purposes?

Don’t just ask, “Which insurance costs the least?”

Rather, start with, “Where am I going?”

Picture the road ahead and then choose what fits that journey.

- In countries where medical care costs a fortune or in places far from any clinic, what could go wrong?

- If my bag disappears or I get sick, how quickly will I need cash or help?

- Thinking about heading to Europe or flying off to the States? Medical bills can pile up fast, so solid coverage really matters.

The Free Travel Insurance You Probably Didn’t Know You Had!

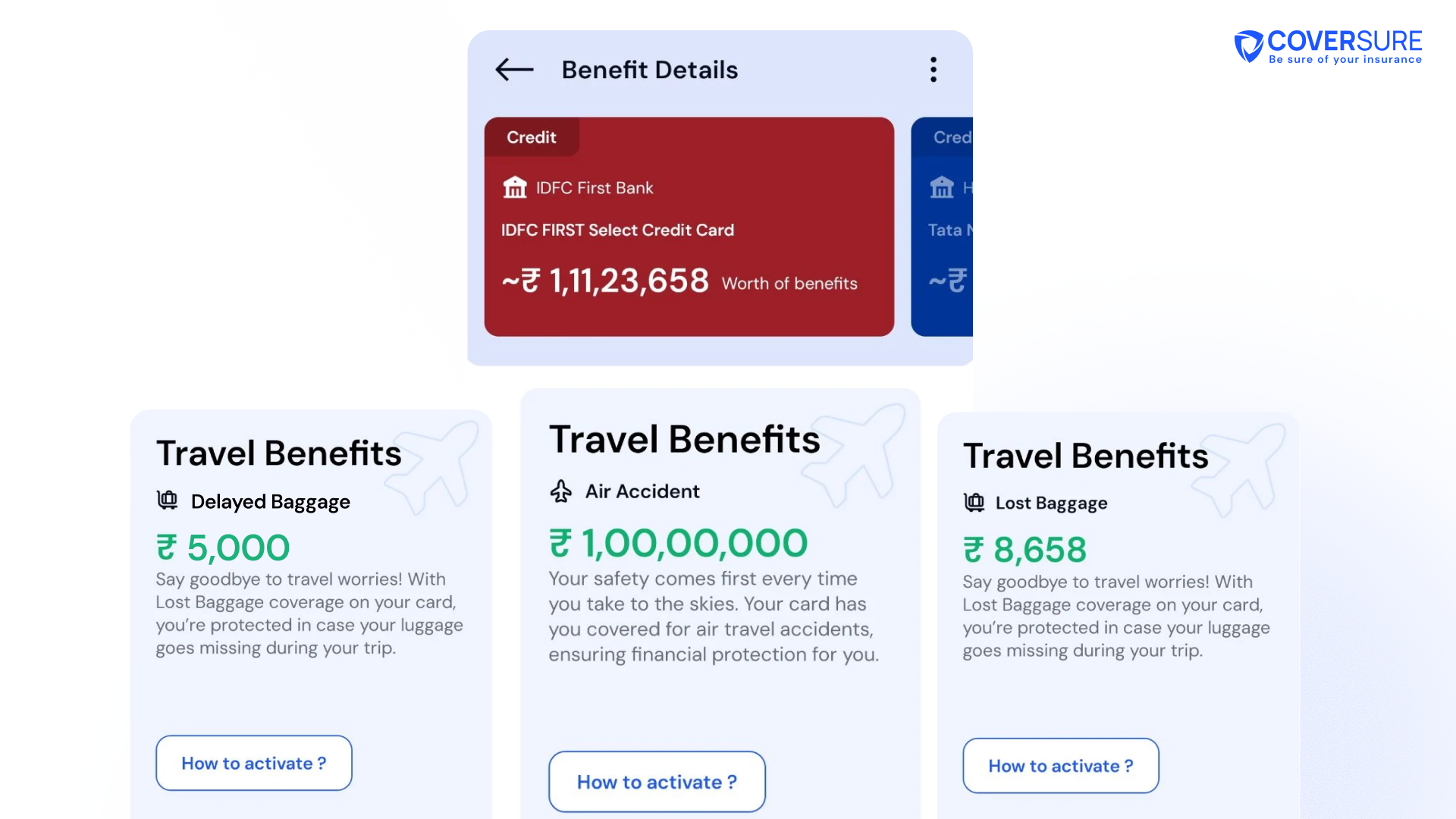

Your debit or credit card might already cover you on trips, quietly offering travel insurance every time you swipe for a ticket or hotel. You might get coverage for lost baggage, trip cancellations, missed connections, or personal accidents!

However, there are a few things you need to be aware of –

- It only kicks in if you meet certain conditions, like buying your tickets with the card.

- Limits tend to be low, and

- Claims mean a ton of paperwork.

CoverSure’s “Insurance on Cards” feature flips the usual script

CoverSure’s IOC focuses on building awareness before any sale. CoverSure believes smart insurance choices start with awareness.

The Insurance on Cards feature in the CoverSure app pulls everything into view. It shows every insurance benefit tied to your debit and credit cards, breaks down what’s covered, when it kicks in, and how to turn it on, helping you see exactly where your card protection stops and where you might need more coverage; it’s the first tool of its kind built for real transparency.

Most insurance platforms push new plans, overlooking the coverage you might already carry. Rather than pressuring you to pile on more insurance, CoverSure starts by helping you see clearly what you’ve already got, like spreading your current policies out on the table. So any extra coverage you pick feels deliberate, smart, and genuinely worthwhile.

CoverSure Team Tip: Before you travel, double-check your card-linked insurance. However, please don’t count on it as your only safety net.

In A Nutshell

Travel moves fast these days: plans shift, flights pop up often, and a spark of spontaneity sends you racing toward the gate. Illness and accidents never stick to a schedule, and those hospital bills won’t wait while you plan.

That’s why insurance isn’t an afterthought; it travels beside you!

From travel insurance and health cover to global plans, and even that often-overlooked Insurance on Cards, every layer belongs.

The real benefit comes from awareness:

- Recognising what’s already in your wardrobe,

- Seeing what you actually need, and

- Picking a cover that fits the way you move through the world.

When life starts coming apart miles from home, the right insurance doesn’t just save you money, it brings back that quiet sense of calm. And, sometimes, the most important thing you take with you is that quiet peace of mind.