How To Choose The best Health Insurance Plan?

Choosing the right health insurance plan in India is more important today than ever. Rising medical costs, lifestyle-related diseases, and unexpected emergencies can put a huge strain on your finances if you don’t have proper coverage. A well-chosen health insurance plan protects you against high treatment expenses and ensures you can get quality care without […]

Who is the CEO of CoverSure?

CoverSure is owned and operated by Claycove23 Insurance Tech Pvt. Ltd., a registered Indian company licensed by the IRDAI as a Corporate Agent (Composite). The leadership team draws from expertise in insurance, healthcare, and technology, making CoverSure uniquely suited to simplify the insurance experience. Under Saurabh Vijayvergia‘s leadership, CoverSure has emerged as a response to […]

Types Of Insurance On Credit Card

Insurance on credit cards comes in the form of embedded coverages, benefits automatically bundled with your card that most users overlook. These are not optional add-ons or extras you need to buy separately. They’re built into your card benefits and can offer real financial protection when activated. Depending on your bank and card network like […]

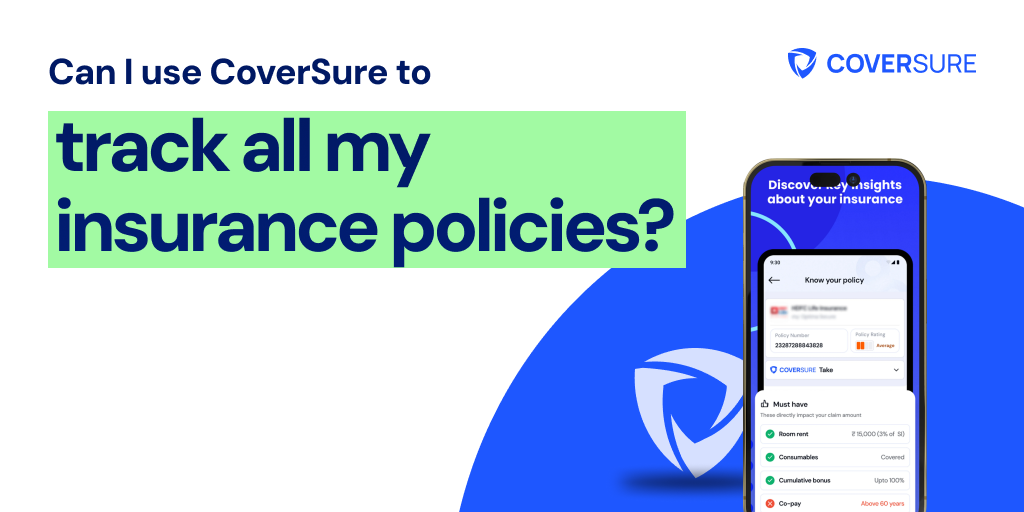

Can I Use CoverSure to Track All My Insurance Policies?

Tracking insurance policies across different providers can be a challenge. As policies often come in various formats and are spread out between insurers, employers, and banks, it’s easy to lose track of details like renewal dates, coverage amounts, and exclusions. This blog post explains how CoverSure helps solve these issues by offering a simple, centralised […]

Meet the team that built the CoverSure app

Founded in 2023, CoverSure is an IRDAI-licensed insurance management platform built to simplify how individuals and families manage, understand, and use their insurance. Our mobile-first service helps users organise and understand their health, motor, and life insurance, check for coverage gaps, and unlock free coverage they might be missing, such as insurance linked to their […]

What Is Cumulative Bonus In Health Insurance?

Most people think of health insurance as something that kicks in only when things go wrong. But there’s a valuable feature in many policies that does the exact opposite, it rewards you when you don’t make a claim. This feature is Cumulative Bonus in Health Insurance, and understanding it can help you maximize your policy’s […]

How to Discover Free Insurance Linked to My Cards Using CoverSure

In India, several credit and debit card users unknowingly skip out on insurance benefits they already have, just because no one tells them. From accidental coverage to health insurance and travel protection, these benefits are often bundled by banks and card networks but rarely activated or claimed. With CoverSure, you no longer need to guess, […]

Is CoverSure a legit insurance app?

Today, when a new financial app or digital service is popping up every day, skepticism is smart, especially when it comes to your insurance. Let’s understand what CoverSure does, how it works, and whether it deserves your trust. Why Does This Question Matter? For many policyholders, insurance is already complicated enough. With rising concerns around […]

Is CoverSure Free to Use?

CoverSure is an IRDAI-licensed insurance platform designed to simplify how you manage, understand and use your insurance policy. It also provides unbiased guidance on buying and renewing health, life and motor insurance With CoverSure, you can One of the most common questions we get is whether CoverSure is free to use. CoverSure’s core features are […]

What Is Super Top Up In Health Insurance?

In India, health insurance is essential to protect your savings from rising medical costs. But a single policy might not cover all expenses if you face a major illness or repeated hospitalisations. This is where a Super top up health insurance acts as an additional layer of cover over your base health plan. It’s designed […]

How Much Critical Illness Cover Amount Do I Need?

Serious health conditions are rising fast, and the impact goes far beyond treatment costs. It can disrupt your income, drain your finances, and create long-term financial stress. A critical illness policy offers a lump sum payout to help you manage treatment costs, replace lost income, and cover daily expenses. While critical illness insurance costs a […]

What Is Deductible In Health Insurance And How It Impacts Your Plan

Confused about how deductibles work in health insurance? This guide explains what a deductible is, how it affects your claims, and why it matters in policy selection.